7 Ways Farfetch is Disrupting Luxury Retail

By Tricia McKinnon and Emily McCullough

It’s almost hard to believe there was a time when the luxury industry shunned online sales. But it’s true. The prevailing wisdom at the time which hasn’t gone away completely is that you can’t translate a high touch experience, one often involving thousands of dollars, online. Then the COVID-19 pandemic hit and consumers around the world were forced to shop online sending digital sales to levels never seen before. While the shift towards selling luxury goods online took place before 2020, the pandemic cemented a new way forward. While stores will always have value all brands are constantly thinking about how best to serve their consumers digitally.

Farfetch, which launched its luxury goods online marketplace 15 years ago in 2008, clearly had a vision of what online luxury sales could be before many woke up to this reality. With a head start compared to many luxury brands Farfetch was ready when the pandemic hit, with revenues up 35% in 2021 reaching $2.26 billion. Then last year Farfetch brought in $2.32 billion in revenue. If you are curious about how Farfetch is disrupting luxury retail then consider these eight factors.

1. Farfetch got its start by giving small brands without an eCommerce presence a way to sell online. Over the years, as Farfetch reached scale, other brands followed with some of the biggest luxury brands in the world selling on Farfetch including Alexander McQueen, Burberry, Balmain and Gucci. Farfetch has over 3,500 labels on its platform.

2. Farfetch generates revenue by taking a commission on sales from brands that sell on its platform. Commissions typically range from 25%-33% depending on whether in addition to providing eCommerce functionality Farfetch manages shipping, returns or other services. When Farfetch started out it did not own the inventory from the brands appearing on its platform instead letting brands take on that risk. But with its acquisition of Browns in 2015 it started taking on some of its own inventory and also began operating stores.

Under this model where Farfetch does not own the inventory brands have more control over merchandising, pricing and the customer experience. With more pricing control brands can offer more merchandise at full price, avoiding markdowns which are thought to negatively impact a luxury brand’s image. This model is in contrast to Net-a-Porter which operates primarily a wholesale model where it owns the inventory sold on its site. But Net-a-Porter has come around and is now adding more concession agreements.

3. Farfetch’s scope and ambitions go beyond online sales. It sees itself as a leader in digitizing the luxury experience offline. One way it has done this is to create tech enabled stores. It did this through a partnership it had with Chanel that started in 2018. Some of the experiences Farfetch worked with Chanel on include an app that allows Chanel customers to book an appointment with a sales associate. Before a customer’s appointment they can select looks for the sales associates to pull so they are ready when the customer arrives at store. Fitting rooms also have smart mirrors that display the customer’s fashion choices and provide recommendations for other items such as accessories that will meet the customer’s needs. The mirrors also provide a view of what the merchandise the customer is interested in looked like when it was on the runway including a video of the model wearing it.

Speaking about the partnership in 2018, Chanel’s president of fashion Bruno Pavlovsky said: “imagine a customer can book an appointment through WeChat or Whatsapp and say they would like to come at two o'clock to see in the fitting room this silhouette or this bag or this shoe. If we want to enrich the customer experience, we have to think about a range of services like that.”

A Chanel employee had this to say about the initiative: “for me it’s the meeting of the retail excellence of Chanel and the digital excellence of Farfetch. They are convinced that luxury shopping will still happen in boutiques in 10 or 20 years. And on our side, we want to think of the clients of tomorrow, so we want to test this new client experience. It’s a test and learn approach.”

Do you like this content? If you do subscribe to our retail trends newsletter to get the latest retail insights & trends delivered to your inbox

4. Farfetch’s ambitions are not limited to simply being an intermediary between brands and their customers. In 2019 Farfetch bought New Guards Group, which owns several streetwear labels including Off White, for $675 million. Farfetch sees that move as the company’s way of creating its own content.

“You saw with Netflix: it started as an aggregator of other people's movies and eventually they figured out that if they really wanted to bring their platform to another level, they had to start to be an active participant in that culture,” said José Neves, Farfetch’s founder. “The first 10 years of Farfetch, we've signed the most beautiful boutiques, 500 brands, we've created the logistics, the transaction engine, the platform to be able to offer this community access to a global consumer. But now is the time to become culturally relevant as a brand, not just as a transactional platform.”

It’s a strategy that is a familiar one in the retail industry. All large successful retailers sell merchandise under their own brands. Costco makes billions of dollars off its Kirkland private label brand and even Amazon has its own brands including Lark & Ro and Amazon Basics.

In 2021 Farfetch brought its vision of creating its own content into reality when it launched its own private label brand called There Was One, a line of elevated basics. "There Was One is exactly what so many people are looking for now – enduring fashion that will be in their closets for years to come," said Holli Rogers, Farfetch’s chief brand officer.

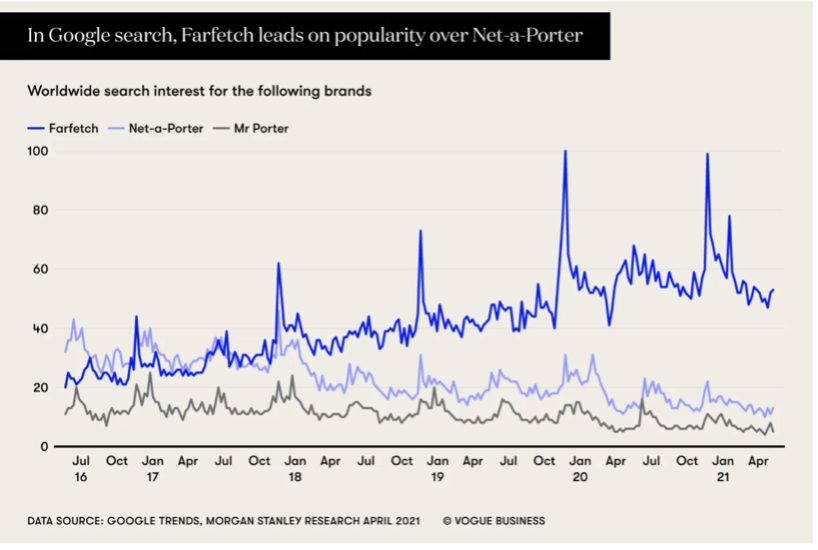

5. While at one point in time Net-a-Porter was the only game in town Farfetch has made considerable headway in terms of luxury fashion online marketplaces.

Seeing the writing on the wall, Richemont which owns Net-a-Porter started cozying up to its arch rival Farfetch. In 2020 Richemont along with Alibaba invested $1.1 billion in Farfetch. The deal allowed Farfetch to launch stores on Alibaba’s luxury pavilion giving Farfetch access to Alibaba’s massive customer base.

“The bar to sell in China is quite high for brands on their own,” said Christina Fontana, Alibaba’s former fashion and luxury director for Europe. “Setting up a legal entity in China is time-consuming and difficult. This is one of the reasons we started partnerships with marketplaces like Net-a-Porter and Farfetch. The brands that sell on those platforms now also have a presence in China.”

6. Last August Farfetch purchased a 47.5% stake in its rival Yoox Net-a-Porter which operates luxury eCommerce site Net-a-Porter. The transaction will move the brands towards “building an independent, neutral online platform for the luxury industry that would be highly attractive to both luxury brands and their discerning clientele,” said Johann Rupert, Richemont’s chairman. As a part of the deal Net-a-Porter will transition to Farfetch’s technology platform.

But there are concerns surrounding this deal. “The market continues to worry about the ability of Richemont to close the deal and fully de-consolidate the loss-making YNAP business,” says UBS analyst Zuzanna Pusz. “As such today’s announcement (when European antitrust regulators said Farfetch can proceed with the acquisition) could provide a bit of a relief for investors. Nevertheless, the financial performance of Farfetch since the deal was announced continues to be seen as the main obstacle, with investors worried about Richemont tying itself to a struggling platform and the consequences of such a move in the long-term.” But Pusz believes the deal will go through. “We remain of the view that Richemont is fully committed to exiting the online distribution business, one way or the other, and see no risk of the asset returning to Richemont’s operations.”

The deal will also see Richemont’s brands added to Farfetch’s platform. It is speculated that Richemont will renogiate the terms of the deal since Farfetch’s stock price has fallen since the deal was first announced. “The deal is less financially attractive to Richemont than it was when it was announced 14 months ago,” said Bryce Quillin, economist and brand strategist. “The 90% decline in Farfetch’s share price during this period has pushed down the value of the deal from over $600 million to less than $150 million.”

7. Last April Farfetch invested $200 million in Neiman Marcus Group. The deal will see Farfetch’s technology underpin the Neiman Marcus owned Bergdorf’s website and mobile app. This strategy feels a little like Amazon’s approach to building technologies to power its own business then selling them to others through services like Amazon Web Services. “We are thrilled to be partnering with Farfetch to accelerate our e-commerce strategy, creating a seamless customer experience,” said Geoffroy van Raemdonck, CEO of Neiman Marcus Group. “José and the entire Farfetch team have built a best-in-class technology platform and are the ideal partner to help us grow Bergdorf Goodman to be an even stronger global digital luxury retailer.”

Speaking about the deal with Neiman Marcus Group Neves said: “I believe the U.S. luxury market is at a pivotal point.” “Whilst the U.S. is proving to be a long-lasting source of growth for the luxury industry, fueled by younger generations who are highly engaged with the category, businesses will have to significantly upgrade their digital capabilities.”