6 Global Retail Trends to Pay Attention To

By Tricia McKinnon and Lesley Zheng, March 2020

Around the world the retail sector continues to change at a rapid rate. Never has there been a time when the sector has had so much disruption. China is a leader in modernizing many aspects oretail. From tech enabled stores that allow customers to make payments using facial recognition to using live streaming to drive sales, it is the country to watch if you want a view of the future looks like.

With the onset of COVID-19 there is a new normal in China. One of the changes that will likely leave a permanent mark on Chinese shoppers is a desire to have a healthier lifestyle. The coronavirus is a wakeup call that no one was expecting and it has made consumers reevaluate how they live their lives.

India is often called the next big retail opportunity. With a population of over a billion people many Indians are now coming online for the very first time. Walmart and Amazon have already made significant investments in this market since if they can get in early, capture share and trust then the future is theirs to take.

While the eCommerce market is nascent in India, it much more evolved in the UK. eCommerce as a percentage of total retail sales is the second highest in the UK. This is one of the factors that has contributed to a high number of store closures on the high street in the UK. But this is not the only reason for a shift to more eCommerce. Consumer shopping habits have changed with consumers focusing less on buying things but favouring services and experiences instead.

If you want to take a look at what’s going on in retail around the world here are the trends you should consider.

CHINA

1. Increased demand for healthier products

As with any life-threatening situation like the COVID-19 pandemic it makes people pause and take stock of their life. In China, purchases of vitamins, minerals and supplements quickly spiked after the onset of the pandemic. Now that consumers are more aware of their mortality it is likely they will continue to be more health conscious in the future. For example, 75% of Chinese consumers surveyed said they will adopt a healthier lifestyle as a result of the pandemic.

Speaking about changes in consumer behaviour post SARS, Ryan Zhou, Vice President, Consumer Packaged Goods, Nielsen China said “health and hygiene is a natural habit shift post epidemic, and we observed a continuous boom in this area after SARS. Now is a key time for brands to consider upgrading for health and hygiene concepts”

The health and wellness trend has gained steam over the past several years with the global wellness market growing at a rate of 12.8% between 2016 and 2018. COVID-19 will only boost consumers’ focus on this area.

52% of Chinese consumers surveyed said they will look for foods or medicines that will strengthen their health and boost their immunity. It is also expected that there will be a demand for more clean products. This is a movement that has been going on for some time. For example, Sephora launched Clean at Sephora in 2018, an initiative aimed at selling products that are free of toxic ingredients.

2. Live streaming enables the growth of social commerce

Shopping while watching a host sell products during a live event is not a new concept, think QVC. But shopping this way has been updated for the digital age. In China, digital payments, livestreaming and e-commerce functionality are completely integrated within a single eCommerce platform like Taobao or Tmall, both owned by Chinese eCommerce giant Alibaba. It would be analogous to Amazon, Instagram and Paypal being part of the same platform. Viewers can easily purchase products through links while viewing a live stream. This seamless integration has fuelled the growth of live streaming in China.

It is estimated that the live streaming market in China was worth $4.4 billion in 2018 up 37% over the prior year. It may seem like a relatively small base but Alibaba only integrated live streaming on its platform from around 2016. In a few short years more than 100 million people in China watch a live stream each month.

In categories like beauty & personal care, packaged foods and apparel, more than half of consumers discover products through entertainment-driven content. In China KOLs which are Key Opinion Leaders, which are like influencers, are one of the best ways for brands to connect with consumers. Another benefit of live streaming for brands is that unlike QVC live streaming in China reaches a younger audience as well.

Live streaming has also become an important of Alibaba’s Singles Day shopping event. During the last Single’s Day which was held on Nov. 11, 2019 live streaming generated $2.85 billion or 7.5% Alibaba’s gross merchandise volume sales on that day. Taobao’s most successful live-streamer, Viya, livestreamed for 8 hours on Singles Day with 43 million consumers watching. The “Lipstick King” Li Jiaqi spent more than 6 hours livestreaming with 37 million consumers watching. Viya even did a live stream with Kim Kardashian for Singles Day to sell KKW fragrances. 150,000 fragrances were sold within seconds.

The “Lipstick King” Li Jiaqi during a livestream

Speaking about live streaming, Remi Blanchard, a Project Leader at a Chinese market research firm said "product safety and security scandals have made Chinese consumers particularly suspicious towards brands and products, especially when sold online." "[Through a video livestream] Chinese shoppers feel reassured by the in-depth product introduction and testing that KOLs provide them in a live and “no filter” environment."

Amazon also sees potential in live streaming and last year launched Amazon Live. Amazon Live is a live-streaming home shopping platform. The platform consists of Amazon talent hosting live home shopping shows as well as live streams from brands that sell on amazon.com.

Do you like this content? If you do subscribe to our retail trends newsletter to get the latest retail insights & trends delivered to your inbox

3. Social commerce is taken to the next level with group buying

You may have heard about Chinese eCommerce giant Alibaba but what about Pinduoduo? Founded four years ago by an ex-Google engineer, Colin Huang, Pinduoduo is a Chinese eCommerce company that sells a wide range of products including household toiletries, groceries, apparel and electronics. So what makes Pinduoduo so special? For one it has cracked social commerce. The growth of the platform is largely due to recommendations from friends to take part in group purchases which then drive down the price of items for sale.

If Groupon introduced you to the concept of group discounts Pinduoduo is the one that has really taken that to the next level. When shopping on Pinduoduo merchandise features two prices, one price for the item if it is purchased individually and another price if it is bought as part of a group.

To enact group buying all a customer has to do is share a link with the item they want to buy with family and friends via WeChat, China’s largest social network. Once enough people have decided to join in customers can get a “team discount” that provides a discount of as much as 90% off. This strategy has been particularly effective in attracting new customers to Pinduoduo who have discovered the site via friends and family. Since WeChat, which has more than one billion monthly active users blocks links on its platform from rivals like Alibaba it has played a central role in Pinduoduo’s growth.

While Alibaba and JD.com have grown by focusing on affluent customers in cities such as Beijing and Shanghai, 65% of Pinduoduo’s customers are from tier three and lower cities. These cities (tier three and lower) represent 73% of China’s population. These consumers have lower disposable incomes motivating them participate in group buying in order to get the best possible price. For example, the average transaction value on Pinduoduo is $6 versus $60 on JD.com and $30 on Tmall and Taobao (Alibaba).

Pinduodou has grown very quickly. In only two years after launch in 2015 it generated more than $14.7 billion in gross merchandise volume. In contrast it took Taobao (Alibaba) five years to achieve that milestone and JD.com ten years. It is now the third largest eCommerce company in China behind, Alibaba and JD with an estimated 7% market share and 77.5 million daily active users

4. Tech enabled stores are the future of retail

China is considered to be two to three years ahead of the U.S. when it comes to merging digital with offline retail. Two years before Amazon purchased Whole Foods eCommerce giant Alibaba opened its first Hema supermarket in China in 2015 and now there are 150 of these supermarkets in 17 Chinese cities.

Hema, whose English name is Freshippo, is a high-tech supermarket that is designed around your smartphone. Your smartphone is used for everything in the store, from placing items in a digital shopping cart while you shop for groceries, to getting product nutritional information, to paying for your goods. Hema is part of Alibaba’s “New Retail” strategy. New Retail according to Jack Ma is “the integration of online, offline, logistics and data across a single value chain.” It is an initiative aimed at connecting online and offline retail and digitizing stores in order to provide a better customer experience. True to form Hema stores also double as fulfillment centres for Hema’s online grocery orders. Speaking about Hema stores, Alibaba Group President Michael Evans said: “consumers don’t think about the world online versus offline.” “Neither should brands and retailers.”

Customers enjoy the shopping experience at Hema with more than 11 million people signing up for the Hema shopping app. Here are some of the key tech features of these stores.

Scan and go. To shop at Hema customers have to download the Hema mobile app. Once it is downloaded customers shop by scanning QR codes on each item they wish to purchase then the item is added to their digital shopping cart. Scanning a product’s QR code also provides the customer with information about the product including how fresh it is. Other data that is available includes nutritional information, customer reviews, recipes the customer can make using the product as well as delivery options if the customer wants the item delivered to their home.

Part of Alibaba’s success in designing a store around a smartphone app is due to the high mobile phone usage in China. 98% of internet traffic in China is generated on a mobile phone vs. 43% in the United States.

Digital payments including facial recognition. When customers are finished shopping they pay using Hema's mobile app which is linked to Alipay. Alipay, founded by Alibaba, is an online payment app that has more than 1 billon monthly active users. It is the world’s largest online payment platform with more users than PayPal.

At selected Hema locations customers have the option of paying using facial recognition payment technology. At self-checkouts a camera imbedded in the screen of a kiosk scans the customer’s face. Then facial recognition payment technology is then used to verify the customer’s identity. Customers also enter their phone number into the kiosk as a safeguard against fraud.

Initially digital payments were the only option for Hema customers but customers resisted this and the Chinese government found the practice to be unlawful. Hema supermarkets now take cash as well.

Personalized shopping recommendations using artificial intelligence. The Hema app also remembers shopper buying behavior and leverages machine learning to make personalized product recommendations for customers.

Digital price tags. Products have digital price tags that can be updated in real time. They can be particularly useful if Hema wants to, say for example, update the price of seafood based on market rates. It also allows the retailer to ensure that prices online match in-store when necessary. Prices also change based on the time of day.

INDIA

5. eCommerce is the next wave of growth

Currently eCommerce sales as a percentage of total retail sales in India are low at 3% of total retail sales vs. 11.4% in the United States and 36.6% in China. This is due to lower internet penetration rates, a lower income population and a lack of infrastructure to enable digital payments and delivery of orders. But more than half a billion people went online in India in the past decade alone and 700 million more people are still expected to go online in India for the first time in coming years.

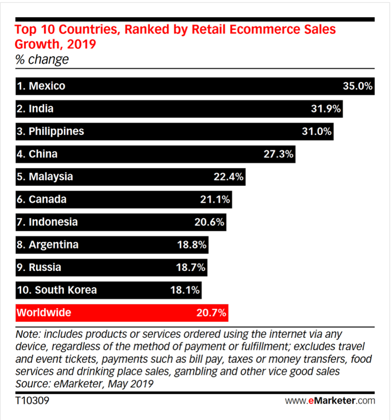

The potential for eCommerce in India is clear. In 2019 India had the second highest eCommerce growth rate in the world at 31.9% behind Mexico but ahead of the Philippines and China. By 2027 it expected that eCommerce sales in India will increase from $46 billion in 2019 to $200 billion.

The potential size of the market as well the fact that India has 1.3 billion consumers and more than half of India’s population is under the age of 25 presents a lucrative opportunity for future growth.

The size of the prize has prompted both Amazon and Walmart to make significant investments in India. Amazon has invested over $5 billion in India while Walmart bought Indian eCommerce leader Flipkart in 2018 for $16 billion, Walmart’s largest acquisition ever.

But investment in India is not without its challenges. Unlike China where mobile payments are common, 60% to 65% of eCommerce orders in India are COD – cash on demand. Many consumers do not trust digital payments and they like to touch and feel products in advance of buying. “In a world where two-factor authentication (for online payments) is required, nothing can beat the convenience of COD. “Then, (some of the) consumers coming online are new and interacting with e-commerce for the first time. It will be some time before this behaviour is changed” said Sanjay Sethi, CEO of online marketplace Shopclues.

Local merchants in New Delhi, India are protesting against Amazon's and Flipkart's (owned by Walmart) presence in their market. They are arguing that the two eCommerce companies have predatory pricing which is against laws protecting local businesses. Small merchants generate 90% of retail sales in India and the country’s slowing economy has only increased tensions. The Secretary General of the Confederation of All India Traders (CAIT) Praveen Khandelwal has said: "both Amazon and Flipkart have left no stone unturned in destroying and devastating the e-commerce and retail trade market by indulging in all kinds of malpractices."

THE UK

6. The high street isn’t dying its just evolving

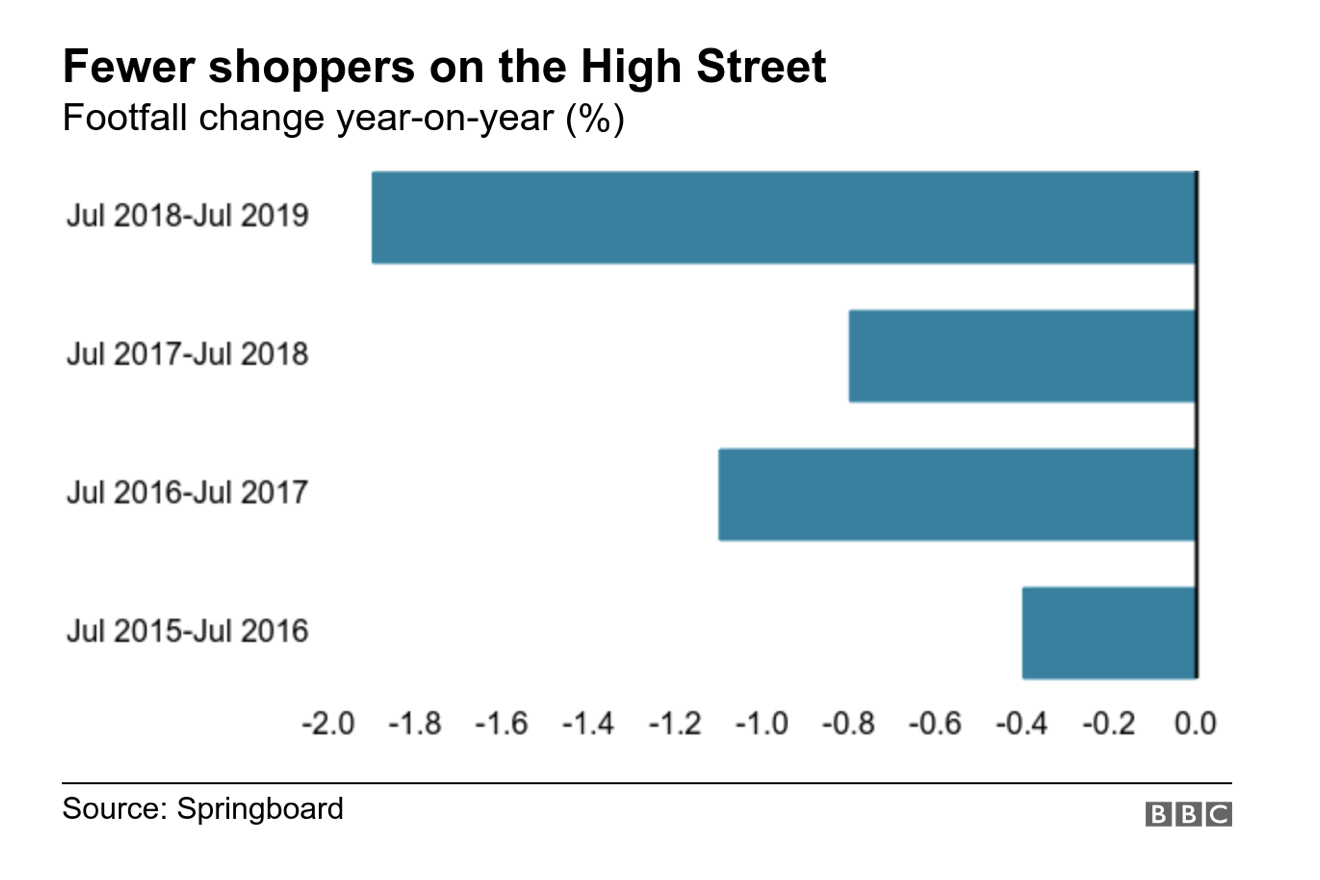

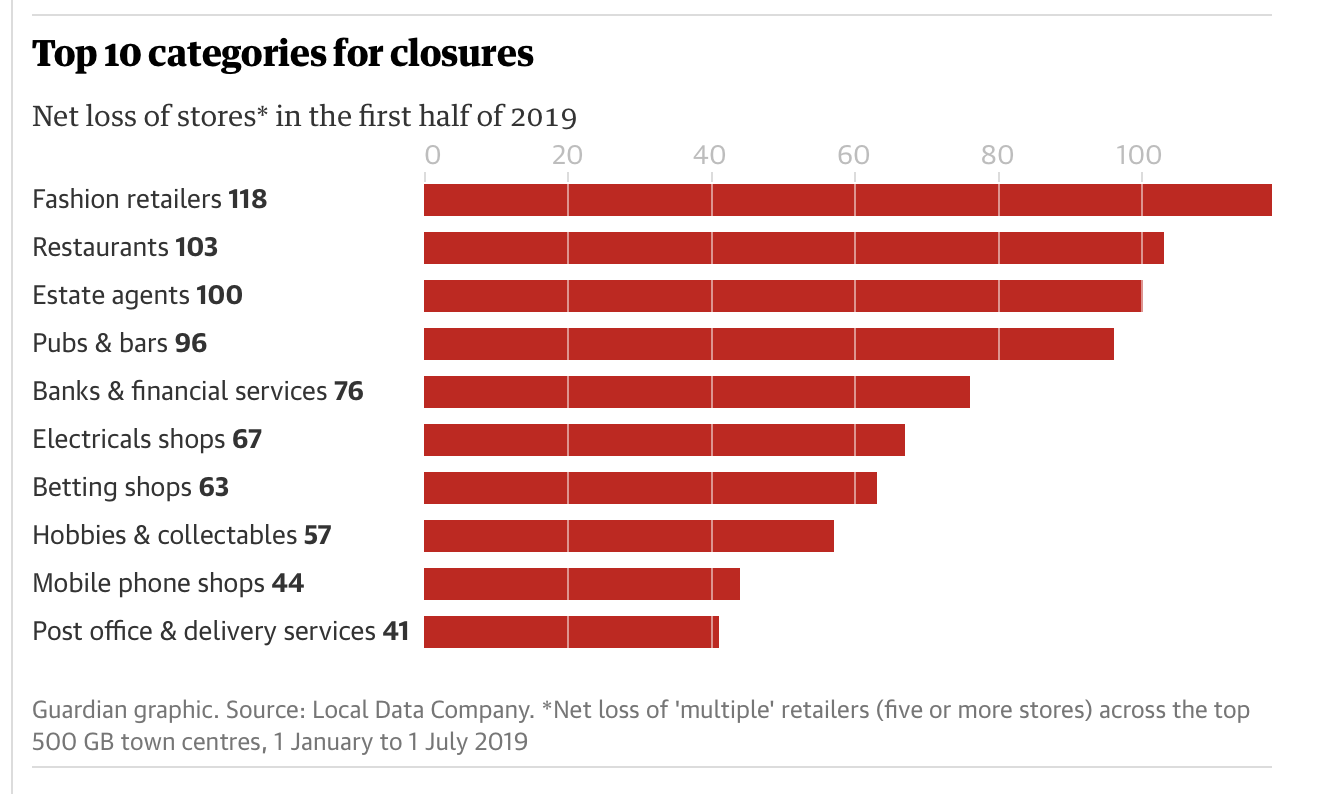

UK’s storied high street is struggling with declining foot traffic and a high number of store closures. In first half of 2019 there was a net decline of 1,234 chain stores on Britain’s top 500 high streets. The category which was most heavily impacted, fashion retailers, is a reflection of changing consumer behaviour. Consumers are spending more money on services and experiences than on things.

This echoes trends found in other regions in the world like North America. In 2002 retail tenants selling goods comprised 53.2% of retail space in the U.S. now service tenants take up 52.6% while those selling products (Gap or a Victoria Secret) comprise 47.4% of space. Retailers and mall operators are focusing on providing more experiences that cannot be replicated offline.

Given the shift towards services it is not surprising that the category that experienced the highest number of store openings on Britain’s high streets was takeaway restaurants. Sports & health clubs, another service business came in second. Full service restaurants have also taken a hit as consumer prefer more convenient options like takeaway that allow them to grab and go.

Online shopping is also taking a bite out of sales on Britain’s high streets. Online sales as a percentage of total sales in the UK are 22.3% which is the second highest in the world after China. Online sales continue to grow quickly in the UK with sales increasing by 9.4% in the first quarter of 2019, the fastest growth on record since online sales growth started to be tracked in 1988.

It is estimated that nearly three quarters of British shoppers use the high streets to browse but then make purchases online. Looking at why British consumers like to shop online, those surveyed said: online shopping offers better convenience (58%), the option to have shopping delivered (46%) and better deals (44%).