4 Elements of Amazon’s Strategy to Watch

When most people think of Amazon they see Amazon as the everything store, a place where they can find most of what they need and have it delivered so quickly there is no need to trek to a store. While that is Amazon’s claim to fame Amazon should also be known for its ability to redefine what it means to be a retailer. Before Amazon most retailers where primarily in the business of selling goods. Then Amazon comes onto the scene and shows the retail industry there are other ways to make money including by having a lucrative cloud business or through advertising sales.

If you have a traditional retail business or a pure play eCommerce company then Amazon is a great model not just for how fast goods should be shipped but also for how to think differently about how to monetize your customer base. If you are curious about what Amazon has been up to lately then consider these four elements of its strategy.

1. Expand further into the healthcare sector. Last month Amazon purchased One Medical, a primary healthcare practice, for $3.9 billion making it Amazon’s third largest acquisition to-date. One of One Medical’s key promises is 24/7 access to virtual healthcare. This acquisition adds to other moves Amazon has made in the healthcare sector including its purchase of PillPak, an online pharmacy, in 2018 for $753 million. In addition to getting more of your wallet, a service business like this has better margins than Amazon’s retail business and is less capital intensive.

Amazon launched Amazon Pharmacy in 2020 which offers online ordering and delivery of prescriptions. Users of this service receive discounts if they have an Amazon Prime membership. Online pharmacy services is a large market, expected to reach $131 billion globally by 2025. “As more and more people look to complete everyday errands from home, pharmacy is an important and needed addition to the Amazon online store,” said Doug Herrington, senior vice president of North American Consumer at Amazon.

"The question is, as you sort of put all of these pieces together, could they create a much more convenient, holistic health care experience for people?" asked Dr. Aaron Neinstein, a digital health expert at the University of California. "What Amazon has become known for is they really understand as a consumer what you want and how to get it to you really easily."

2. Continue brick and Mortar expansion. While Amazon got its start in eCommerce it knows the importance of having a brick and mortar presence. In the second quarter of 2022 only 14.5% of retail sales in the United States came from online orders. That means Amazon’s future success depends on going deeper into offline sales. What many people don’t know is that Amazon already has quite a large offline presence. It has over 600 stores which means it has more stores than chains like Trader Joe’s or lululemon have.

There are a number of benefits of having more brick and mortar stores. One of the benefits is that it makes returns easier. If you have ever spent a Sunday afternoon getting your Amazon packages ready to be returned by printing packing slips and putting your items back inside its packaging you know it might be easier to simply drop off your returns at a nearby store. There are also millions of people that live in apartment buildings where they don’t have a doorman to keep an eye on their purchases. In those cases consumers would rather have a place where they can pick up their purchases. That’s one of the reasons why click and collect is so popular.

Many years ago Jeff Bezos said that if Amazon is to become a $200 billion retailer it needs to figure out food. Well Amazon has gone well pass the $200 billion mark achieving $469.8 billion in revenue last year but it’s still trying to make its mark in the food category. The reason why selling food is important is because it’s a frequently purchased item and you need it to survive. You can cut down on clothing purchases, spend less on electronics but you can’t get away with not eating. One of the reasons Walmart became the behemoth it is today is because it started selling groceries in 1988 many years after it got its start as a general merchandise retailer in 1962.

Food is a category that still has a low eCommerce penetration since consumers like to touch and inspect their food before purchasing it. That’s why if you are a food and beverage retailer, stores matter a lot. With this in mind Amazon launched a grocery chain called Amazon Fresh in 2020. Amazon Fresh supermarkets are small, between 25,000 sq. ft. to 45,000 sq. ft. In contrast the average size of a Walmart, Amazon’s nearest competitor, is around 180,000 sq. ft. Amazon knows that smaller stores are easier to manage, require fewer employees and they force Amazon to select the best inventory since there is limited selling space.

In addition to Amazon Fresh other brick and mortar stores Amazon has include: Whole Foods and Amazon Go convenience stores, which have the option for cashier free checkout. Amazon also opened its first clothing store earlier this year called Amazon Style. The 30,000 sq. ft men’s and women’s store sells hundreds of clothing and accessories brands including Amazon’s own private label brands. "Customers enjoy doing a mix of online and in-store shopping. And that's no different in fashion," said Simoina Vasen, managing director of Amazon Style. "There's so many great brands and designers, but discovering them isn't always easy."

Do you like this content? If you do subscribe to our retail trends newsletter to get the latest retail insights & trends delivered to your inbox

3. Give customers more compelling content. Amazon has revolutionized retail in many ways. While you may be thinking of eCommerce, consider how it has taken the sleepy old loyalty program to another level. For example, as part of your Amazon Prime membership you can stream movies and TV shows. Who would have thought consumers would want more than points off their next purchase or product samples? Clearly Amazon was thinking outside of the box when it decided streaming would be an effective way to lure customers into Prime.

To provide even more content for Prime members to consume in May Amazon announced it is purchasing MGM Studios for $8.5 billion. It is Amazon’s second largest acquisition behind Whole Foods. MGM Studios owns many popular franchises including James Bond, Legally Blond, Rocky and the Silence of the Lambs. The deal means that Prime members get access to more than 4,000 movies and 17,000 TV shows.

Amazon’s acquisition of MGM Studios is just one of many attempts by Amazon to give Prime members must see content. Last year Amazon made what many believe is a historical deal, it acquired the rights to stream Thursday Night NFL Football. The deal will cost Amazon about $1.2 billion per year. This is the first time NFL games will exclusively be played on a streaming service. That means if you want to watch Thursday Night NFL Football you need to subscribe to Amazon Prime or Prime Video.

Never before has a streaming service acquired the rights to broadcast NFL games exclusively for an entire season. Typically NFL games are telecast on a major television network like Fox. “This is an inflection point,” said Daniel Cohen, executive vice president at Octagon. “We’ll look back on this season of Amazon exclusively producing and distributing NFL games as a turning point in sports broadcasting.”

You can just imagine how many football fans will be willing to subscribe to Prime just so they can watch their favourite teams play. Amazon estimates that more than 12 million people will watch Thursday Night NFL Football. Unlike the offers in many loyalty programs the ability to watch NFL games is a compelling reason for someone to subscribe to Prime. “We’re confident we’ll not only see a lot of people signing up for Prime but also exposed to other parts of the Prime membership,” said Jay Marine, vice president of Prime Video and global head of sports at Amazon. “We have a long-term horizon. While we’re focused on the first game, success is really going to be ‘How are we doing three, five, seven, 11 years from now?’”

The deal with the NFL signifies how popular streaming has become. In the last year around 80 million households in the United States watched Prime Video at least one time. Amazon really deserves credit for the ability to see what will resonate with consumers well in advance of other retailers. "We find video as a really strong attractor of customers, and it's a gateway to Prime," said Amazon’s CFO Brian Olsavsky.

4. Continue to increase advertising sales. Acquiring the rights to stream Thursday Night NFL Football helps Amazon to build its lucrative advertising business which brought in $31 billion last year. By having the rights to Thursday Night NFL Football Amazon will be able to secure advertising that previously flowed to TV broadcasters. It is estimated that the TV advertising market in the United States is worth $66 billion.

Amazon now has the third largest digital advertising business in the United States behind Facebook and Google. It is expected that Amazon will have a 14.6% share of digital advertising sales next year in the United States. This is remarkable since Amazon only had 7.8% share just a few years ago in 2019.

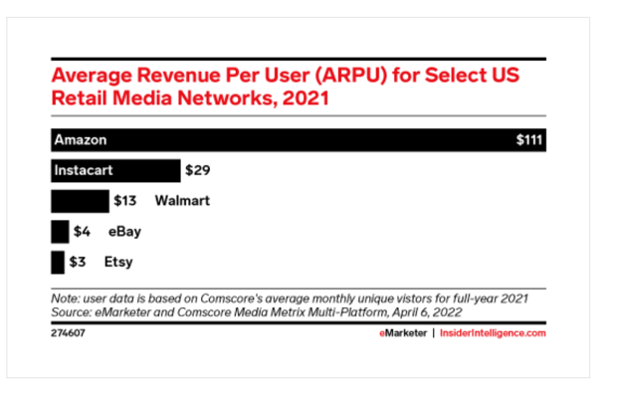

Walmart is also trying to build its advertising business but Amazon is still way ahead.

“Long term I think Amazon is building an absolute advertising juggernaut,” said Andrew Lipsman an analyst at Insider Intelligence. Advertising is an important business line for Amazon and other retailers because the margins from advertising sales are much higher than in a retailer’s core retail business.