The Top Retail Trends in Canada in 2020 to Watch

Like many countries around the world retail sales in Canada are rebounding after hitting historic lows at the height of the COVID-19 pandemic but there is still a long way to go. In May, the latest month where retail sales are available, retail sales in Canada were up 18.7% vs. April but were down 18.4% versus last year. Statistics Canada estimates that retail sales will be up by as much as 24.5% in June vs. the prior month.

"While it looks as though retail activity returned close to pre-COVID levels in June, expect the broader economy to experience a longer, more drawn out recovery as the pandemic continues to weigh on a number of sectors." says Bank of Montreal Economist Benjamin Reitze. Overall Canadian retail sales are expected to decline by 6.2% in 2020 more than twice the decline experienced during the 2009 global recession.

Many of the trends prevailing in the retail sector today have existed for a long time with the pandemic bringing them to the forefront. From continued growth in eCommerce to brick and mortar retail refusing to go away to malls struggling for relevancy the pandemic has catapulted the retail sector many years into the future. These are the trends that you should watch as the retail sector in Canada continues to experience unprecedented change.

1. eCommerce surges, but is a distant second to brick and mortar retail

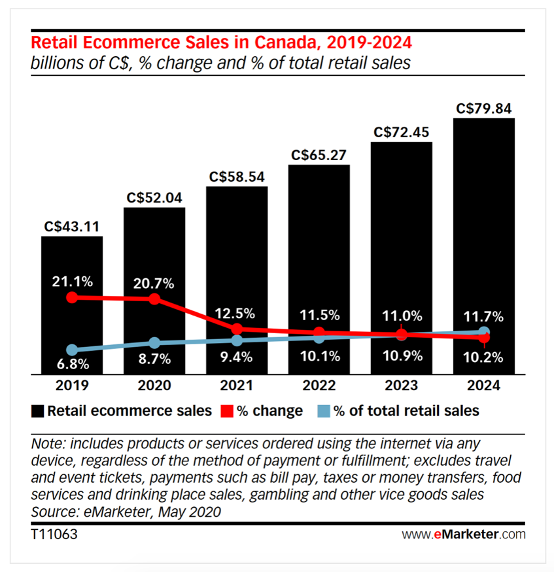

Canadians, like citizens around the world, are turning to eCommerce during the pandemic. eCommerce as a percentage of retail sales in Canada is expected to increase from 6.8% in 2019 to 8.7% in 2020.

Even with the surge in eCommerce, Canada still has one of the lowest eCommerce penetration rates within developed nations. While eCommerce grows Canadians will continue to rely on shopping at brick and mortar stores for the majority of their purchases.

Stores will also play an important role in facilitating eCommerce transactions. This was demonstrated by Walmart’s recent performance in the United States. Walmart’s digital sales increased by 74% in the first quarter of 2020 enabled by the availability of grocery pick up at 3,300 Walmart stores. “Having a wide range of fulfillment options, including delivery to home, collection from store – and by using stores for fulfillment – allowed Walmart to ramp up capacity in a way that many other players struggled to do” said Neil Saunders, Managing Director at GlobalData Retail. That sentiment was echoed when Walmart’s CFO Brett Briggs said: “it is a big advantage being an omnichannel retailer and I think that is showing right now. We were able to quickly use stores to fill online orders.”

Although convenient for customers eCommerce is expensive for retailers. They have to pick, pack and ship orders, all of which has a price tag attached to it. Fulfilling orders from stores can reduce some of those costs. As Bloomberg reported: “if retailers can continue to convert a meaningful portion of that demand into pickup versus delivery, it will provide an offset to the inherently higher supply-chain operating costs of a digital model.” Translation, don’t expect stores to die anytime soon.

Do you like this content? If you do subscribe to our retail trends newsletter to get the latest retail insights & trends delivered to your inbox

2. Apparel sales are in a structural decline

Clothing and accessories don’t have quite the same place in our hearts or in our wallets as they used to. Consumers are spending more money on other categories like technology. Think about the back to school budget for a parent of a 12-year child. How much of it would have went to technology 25 years ago versus today? With a smartphone now a must have purchase there is a lot less money for consumers to spend on categories like clothing.

In May as Canada reopened the economy the category with the largest decline in sales versus last year was clothing. Sales at clothing and accessory stores were down in Canada by 67.6% in May versus 2019. In contrast food and beverage sales were up by 11.6% versus last May. Why buy new clothing if you don’t have to be seen in the office or if the wedding you were planning to attend has been postponed?

This trend is not due just to the pandemic shifting spending to essential retailers, it has been going on for some time. It is also playing out in the United States where In 1920 Americans spent 38% of their income on food and 17% on clothing. Today Americans only spend 10% of their income on food and they spend even less on clothing now, just a paltry 2.4%.

Morgan Stanley believes the apparel market has “hit a ceiling” and is “going into structural decline” and it thought that before the pandemic even hit. It is estimated that apparel sales in Canada could decline by 28% to 32% in 2020 and 2019 apparel sales levels may not be seen again until 2023.

This decline in clothing and accessories sales can also be seen in the retailers that have filed for creditor protection during the pandemic under the Companies' Creditors Arrangement Act which covers businesses that are insolvent. So far in the pandemic many of the companies that have applied for creditor protection are clothing and accessories retailers including Aldo, Reitmans, Laura, Comark (Bootlegger, Cleo and Ricki's) and Moores. It is estimated that 10-15 major Canadian apparel retailers will end up shutting down or significantly reduce their store footprint in Canada.

And when people do spend on clothing they are much more likely to spend at lower priced retailers. This is not surprising since the cost of living in Canada continues to increase. Canadians allocate 43% of their income to housing costs. Only two other countries, the Netherlands and Sweden, out of 20 analyzed spend more on housing as a proportion of their income. Canadians are also heavily in debt with the average Canadian owing $1.77 for each dollar they earn. A survey by BlackRock Inc., a money manager, found that: “many Canadians feel that they are in a financial squeeze — hard pressed to save amid what they perceive as a high cost of living, including devoting much of their income to paying for their homes.”

The shift towards spending less on clothing is also seen by looking at the largest clothing retailers in the world, which are Zara, Uniqlo and H&M. They all target price conscious consumers. As consumers continue to tighten their purse strings amidst unprecedented levels of uncertainty more and more clothing sales will consolidate in the hands of a smaller number of lower priced retailers, pushing out mid-priced retailers like Laura.

3. Malls struggle for relevancy

The decline in mall traffic is another trend the pandemic has amplified. Foot traffic at the top 10 malls in Canada declined by 22% last year. This February mall traffic at those malls was down even more dramatically, by 42% and that was before Canada even went into lockdown. As expected, mall operators are now experiencing unprecedented difficulties with declining sales and retailers shuttering stores. Mall vacancy rates in Canada could triple by the end of the year.

Malls have been in trouble for a long time. Perhaps the best way to describe it is death by a thousand cuts. “Other than the odd one … nobody has built a mall in 25 years. There’s a reason,” said Ed Sonshine CEO of RioCan Real Estate Investment Trust. 10% of RioCan’s portfolio is in shopping malls. “You need huge sales per square foot … They’re very expensive. You’ve got to air condition them. The taxes are extremely high and they take up an awful lot of space.” “The truth is, anything other than those top 20 have been struggling for the last 10, 15 years” he added.

While eCommerce is typically seen as the cause for consumers spending less time in brick and mortar stores there are other underlying trends. Anchor tenants like Sears or Eatons used to be the main attraction at malls, they were the traffic drivers. But over time those retailers became less relevant and both Eatons and Sears went out of business in Canada and you would be hard pressed to find a crowd of shoppers or even a line up on a Saturday afternoon at a Hudson’s Bay store. Similar trends are playing out in the United States. Between 2007 and 2018 the number of department stores in the United States declined by 1,159 while the segment featuring the highest growth, dollar stores, saw its store count increase by 12,535 stores.

If Canada’s population is growing and department stores are out of business or struggling where are consumers spending their money if they aren’t going to malls as frequently? It can’t all be online at Amazon since after all less than 10% of retail sales take place online in Canada. Spending is simply taking place elsewhere. Where might you ask? Let’s take a look at the top five largest retailers in Canada. They are, in order, George Weston Ltd. (Shoppers Drug Mart, Loblaws etc.), Costco, Empire (Sobeys etc.), Walmart and Metro.

If the past if you were shopping for a new outfit on a Saturday afternoon you would go to the Toronto Eaton Centre and shop at Sears or Hudson’s Bay. Now a Saturday afternoon often looks more like this. You get into your car and drive to a Costco or a Walmart which have many off mall locations. You pick up some groceries and then while you are there you buy some clothing because the prices can’t be beat. One of the reasons Walmart has focused so much on building its grocery business is because it drives frequency of visits. You go in, grab some food then you stay a while to buy other things likes underwear, shirts and pants.

While Canadian data is not available, it may surprise you to know that Walmart is the second largest clothing retailer in the United States (behind Amazon). Costco sells $7 billion worth of clothing per year in the United States which is more than consumers spend at Old Navy, or Ralph Lauren. “Costco has quietly become an apparel destination,” says Simeon Siegel, a retail analyst at Instinet. “It is clearly resonating with shoppers and winning over brands at the expense of department stores.”

If you can bypass the mall and get what you need at a retailer like Winners that is closer to home then you are going to do that. The success of a mall rises and falls by what’s in the mall. Sounds simple but not acting quickly on shifting trends like the decline in traditional clothing retailers has put many malls in a precarious position.

An interesting question to consider is, do people really hate going to the mall? Or are they tired of the stores in the mall? If you put a new Glossier or Supreme store into your local mall (granted they may not want to locate there) there would be a lot of buzz and traffic. Not too long ago when the second Chick-fil-A location in Canada opened in Yorkdale mall in Toronto there was a line so long to order that it wrapped around the food court and extended down to another level of the mall! If you build it they will come. But you need to build the right thing. It’s not easy. We often tend to try to hold on to yesterday’s successes instead of doing something more radical that may not bring desired returns at first. This is what Disney had to grapple with before launching a streaming service that would cannibalize some of its existing revenue.

The mall is struggling but it’s not dead. There are opportunities to revitalize them and bring in more of the retailers that consumers are looking for and when that doesn’t work expect to see more mixed uses, think condos and office buildings.