Using Marketing to Buy Growth, Why Casper is Struggling

Credit: Casper

When’s the last time you bought a new mattress? Did you make a trip to your local department store or did you venture online? If you bought your mattress online you likely considered buying it from Casper. Casper is a direct to consumer mattress brand that launched in 2014. If you bought your mattress from Casper how did you discover the retailer? Most likely you heard about Casper or keep on hearing about Casper through its marketing efforts, after all in nearly four years, by September 2019, Casper spent $423 million on marketing. Now that sounds like a high amount but how does it stack up against other companies?

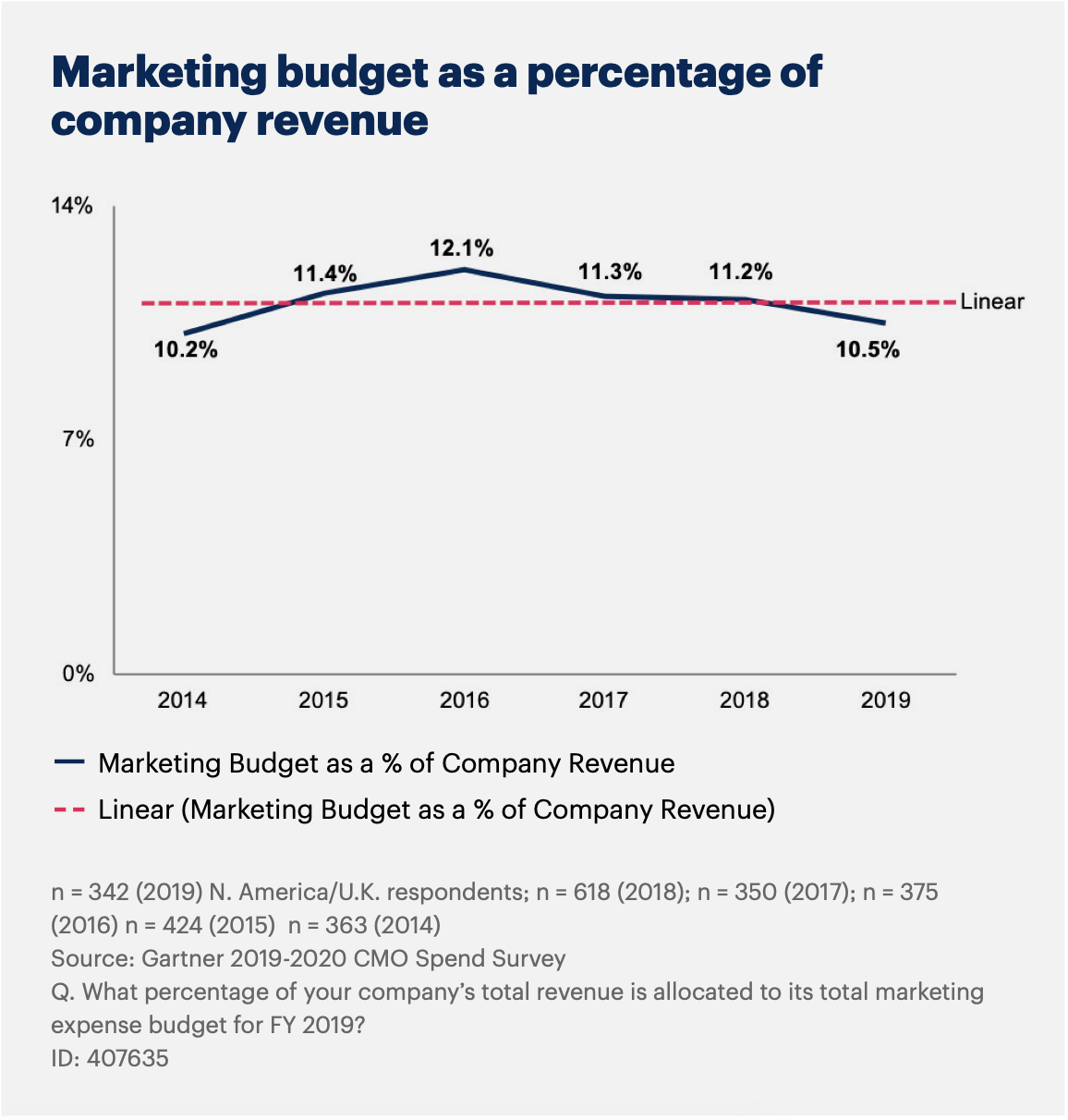

According to a study by Gartner the average marketing spend as a percentage of a company’s revenue is between 10% to 12%. In 2017 Casper’s sales and marketing expenses were 43% of revenue and in 2018 they were 35%. Compare that to Kohl’s whose 2018 marketing costs were 4.9% of revenue or Under Armour which spent 10.5% of its revenue on marketing in 2018.

Maybe you are thinking that since Casper is an online retailer its marketing spend should be justified. But Casper’s marketing expenses are high even when compared to other direct to consumer retailers. Take Stitch Fix. TechCrunch calls the online personal styling retailer “the most cash efficient e-commerce marketing machine since the start of the modern Facebook marketing era.” Its marketing spend as a % of revenue pre-IPO was only 3%. Wayfair, another online retailer spent 16% of its revenue pre IPO on marketing.

How direct to consumer brands drive growth

One thing that is distinctive about direct to consumer brands at least when they start out is that they do not have stores. While not having stores sounds like a cool concept in theory it is very difficult to build a retail business that way. Nearly 90% of retail sales still happen in store making the potential for sales growth if one is targeting only digital sales, less lucrative. Even if sales are high in early years at some point if a company wants to expand it has to sell offline. That is part of the reason why Amazon has so many stores. It is also the reason why hugely successful digitally native brands like Kylie Cosmetics eventually started selling at Ulta Beauty and is the reason why Warby Parker now has over 90 stores after launching with an eCommerce only business.

If a retail brand doesn’t have stores how should it acquire customers? It often invests heavily in marketing. Casper generates three dollars in revenue for every dollar it spends on marketing. Ouch. That does not sound like a sustainable cost structure or business model. Without stores how do consumers find out about a new product? There’s no walk-in traffic on the internet. In the absence of a physical store where customers can see and touch your product you have to advertise or else customers will not know that you exist. Casper has a small number of stores and admitted that in 2019 in cities with Casper stores, sales grew twice as quickly as those without. Casper is now planning to have as many as 200 stores.

The real question is what is the best way to build a retail business? Would Casper have been better off with a model that has a mix of stores and eCommerce from the beginning? Part of the issue with building a business on great marketing is that it hides potential cracks in the company’s business model (remember WeWork?).

When lululemon launched it didn’t have any money to spend on marketing. Instead it created a community-based marketing strategy where it got local yoga instructors to wear its clothing while teaching free yoga classes to build a community and attract new customers. The brand, according to founder Chip Wilson, grew slowly by word of mouth since the company couldn’t fund marketing efforts. 20 years later lululemon has one of the strongest brands, with a cult like following that any retailer would be envious of.

Part of the challenge with Casper’s business model is that mattresses are not frequent purchases. Only 16% of Casper’s customers make repeat purchases. Those economics might work if you are selling Porches but mattresses are not a super high ticket item. With such a low repeat purchase rate Casper has to continually find new customers. Unlike a grocery retailer like Walmart Casper lacks the frequently purchased items required to generate a steady flow of revenue from existing customers. Compare this with Stitch Fix. In 2017 86% of Stitch Fix’s sales came from customers that were acquired between 2012 – 2016. With numbers like that it can be the most efficient marketer in the world.

Casper is aware that it needs to increase its repeat purchases and as a result it has introduced new products outside of its core mattress business. Casper is focusing on the “sleep arc” now. In Casper’s pre IPO S-1 filing it wrote: “we believe that sleep consists of more than just the act of sleeping, and instead, includes the entire set of human behaviors that span from bedtime to wake-up and affect sleep quality.” As a result Casper is now selling a product called a Glow Light which is a lamp that lights up and dims based on your circadian rhythm. If you want one it will cost you $129. Casper also sells weighted blankets now.

\Do you like this content? If you do check out our: Complete Startup Guide for Direct to Consumer Retailers to give you the resources you need to get your business off to a great start!

In 2018 Casper lost $92 million on revenues of $358 million. It has not been able to turn a profit since it has been in business. Speaking about Casper, Jason Stoffer, a Partner at venture-capital firm Maveron said: “for this company to become sustainable and profitable, they either need to become much more efficient on the marketing side, or they need to figure out how to generate more lifetime value out of their customer base.” They need “probably both.”

Casper acknowledges that its success is tied to marketing. In its S-1 filing Casper wrote: “our future growth and profitability depend on the effectiveness and efficiency of our marketing programs.” When you take a look at Stitch Fix the “most efficient marketer” in the Facebook marketing era you realize it’s not marketing that is really driving growth. It has a service customers want and frequently.

Customers using Stitch Fix pay a styling fee of $20 and receive a box of clothing based on their tastes. The $20 is applied as a credit toward anything the customer decides to keep. When you have a product or service that works marketing becomes less important. And since most people update their wardrobes fairly often frequency of customer visits is built into Stitch Fix’s business model, thus reducing the need for high levels of marketing.

Customer returns are also a thorn in Casper’s side. In 2018 Casper spent $80.7 million on “refunds, returns, and discounts”. Returns go hand and hand with an eCommerce business. It is estimated that the return rate for returns of online orders is three times that of orders made in store.

Generous return policies are often given as a way to entice customers to try the product. But if conversion rates aren’t high then costs can quickly spiral out of control. Customers can try out a Casper mattress for 100 days and return it if they are not satisfied for free. Generous return polices are really just another marketing tactic to drive customer acquisition. As David Hsu, a professor of management at the University of Pennsylvania's Wharton School said Casper has "a very expensive [business] model, particularly because of their guarantees."

The lesson here for all brands is that great marketing is not a substitute for a great business model.

You may also like:

Why D2C Brands Turn to Wholesale & Brick & Mortar

Top 10 Mistakes Direct to Consumer (DTC) Retailers Make that Hinder Success

5 Customer Acquisition Strategies Used By Top DTC Brands

Allbirds’ Strategy, 5 Reasons it Grew into a Billion Dollar Company

eCommerce and its Profitability Issue. Why its So Hard to Make Money