11 Things to Know About China’s eCommerce Market

With $1.4 trillion in sales, China has the largest eCommerce market in the world, by a large margin. While in North America eCommerce is synonymous with Amazon, Alibaba often comes to mind when someone needs to order something online in China.

Chinese eCommerce companies like Alibaba are highly innovative and are often the first to rollout features we eventually see, sometimes years later, in the West. If you are curious about the eCommerce market in China then consider these 11 facts about its size, competition and trends.

1. China has the largest eCommerce companies in the world. The Chinese eCommerce market is dominated by several eCommerce giants, the largest of which is Alibaba. Alibaba generates a higher gross merchandise volume (GMV) than any eCommerce company in the world including Amazon. Alibaba has a 47.1% share of the eCommerce market in China and coming in second is JD.com with a 16.9% share. Alibaba had 1.3 billion annual active customers last year while JD.com had 552 million active accounts in the year ended September 2021.

2. China’s eCommerce sales growth is slowing. China’s eCommerce market is maturing and is expected to grow by 15% between now and 2025 while the rest of the world is expected to grow at a rate of 52% during that time period. This deceleration in growth can be seen with Alibaba. In the fourth quarter of 2021 Alibaba generated revenues of $37.6 billion. But its revenues only grew by 10% over last year, the lowest growth rate since Alibaba became a public company in 2014.

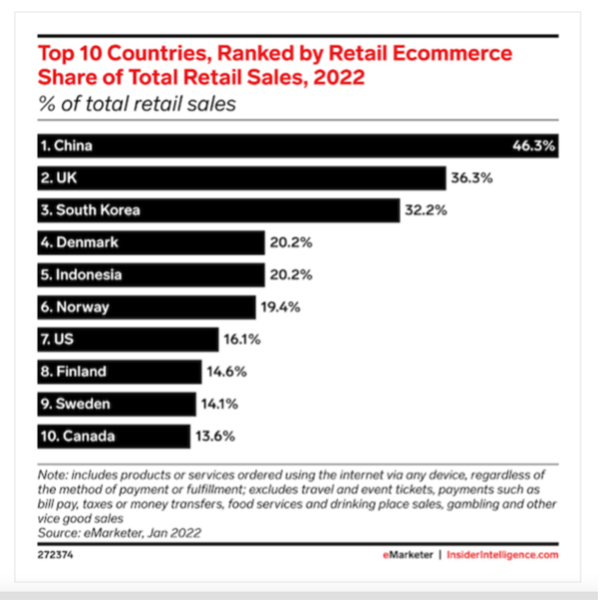

3. China has the highest eCommerce penetration rate in the world. Close to a decade ago the eCommerce penetration rate in the United States and China were close with eCommerce making up a 4.9% and 5% share in the United States and China respectively. Fast forward to now and China is way ahead with eCommerce taking in a 46.3% share of retail sales in the country while eCommerce makes up 16.1% of retail sales in the United States.

4. Stores play an important role in eCommerce. “While online shopping definitely accelerated in 2020 [in China], saying physical retail is more or less obsolete is not true,” said Nishtha Mehta, a China-based corporate innovation coach. “In fact, we saw the acceleration of offline retail as well—there’s more of a shift toward a true omnichannel integration.”

Do you like this content? If you do subscribe to our retail trends newsletter to get the latest retail insights & trends delivered to your inbox

5. Ultra fast delivery of online orders is common. More than a decade ago in 2010 JD.com started offering same day and next day delivery and claimed it was the first eCommerce company in the world to do so. By contrast Amazon started offering same day Prime delivery in 2019. In 2020 90% of JD.com orders were delivered either on the same day the customer made their order or on the next day. In 2020 JD.com started offering even faster one hour delivery called Instant Delivery.

JD.com also owns a chain of grocery stores called 7Fresh that provide ultra fast delivery. Shoppers who live within 30 km of a 7Fresh store can get their groceries delivered to them in as little as 30 minutes. Alibaba’s Freshippo grocery stores also deliver groceries within that timeline.

6. Community buying is a popular way of shopping. Another trend that is popular in China is community buying. The community buying model, popularized by online Chinese retailers like Pinduoduo allows a pool of shoppers to buy goods in bulk at lower prices than what they would pay if they bought the same goods individually. It’s a model reminiscent of Groupon and it has taken off in China. Pinduoduo, for example, grew from zero to over 800 million users in only six years using this model. With this segment of eCommerce growing quickly Alibaba wants a piece of the action. To that end Alibaba launched a community buying platform called Taocaicai to capture market share in lower tier cities in China.

7. China has the largest market for social commerce. Social commerce, which is eCommerce sales that are made on a social media platform, is a big business in China. It is estimated that social commerce sales in China reached $351.7 billion in 2021. That is 10 times more than the social commerce sales generated in the United States which reached an estimated $36.6 million in social commerce sales last year.

One of the apps driving social commerce sales in China is Douyin. Douyin is the Chinese version of TikTok and is also owned by ByteDance. Douyin is a very popular social commerce app in China with 670 million users.

8. Live streaming continues to grow. Live stream shopping has taken off in China generating an estimated $470 billion this year. Live stream shopping is not a new concept, think QVC. But shopping this way has been updated for the digital age and has proven to be popular in China.

In China, digital payments, live streaming and eCommerce functionality are completely integrated within a single eCommerce platform like Alibaba’s Taobao or Tmall. It would be analogous to Amazon, Instagram and Paypal all being part of the same platform. Viewers can easily purchase products through links while viewing a live stream. This seamless integration has fuelled the growth of live streaming and social commerce in general in China.

9. China has the highest number of social buyers globally. “Many of the country's most popular ecommerce platforms are heavily integrated with the most popular social networks, boasting innovative services like Mini Programs [light apps] and live streaming commerce. These and other services frequently offer the best deals on products, and they make social buying extremely engaging and convenient,” says Nazmul Islam, eMarketer junior forecasting analyst.

10. Digital Payments. Even struggling artists playing music outside on the street in China looking for donations take digital payments. The two main mobile payment platforms, WeChat and Alipay have more than 1.2 billion and 700 million monthly active users respectively. In contrast, Apple Pay which comes pre-installed on the iPhone has more than 40 million users..

China is much further ahead of the US in mobile payments. By 2016 Chinese consumers spent $6 trillion on mobile payment platforms, 50 times the amount spent in the US.

11. The Chinese government is cracking down on anti-competitive behaviour and in light of this last year Alibaba was fined a record $2.8 billion in a sweeping anti-trust probe. The government found Alibaba was forcing merchants to sell exclusively on its platform through a practice known as “choosing one from two.” China’s State Administration for Market Regulation (SAMR) said this practice: “infringes on the businesses of merchants on the platforms and the legitimate rights and interests of consumers.”

Another practice the government has an issue with are the so called “walled gardens” large Chinese eCommerce companies have erected. This practice involves banning links from other eCommerce companies from being used on their platforms. For example, while using Tencent owned social messaging app WeChat users can’t view links from Alibaba’s Taobao or ByteDance’s Douyin. Removing these walled gardens will allow users to view content from different sites without having to switch apps. The government alleges that by using practices like these eCommerce companies are trying to build monopolies and are restricting consumer choice.

"We will urge related companies to follow requirements and open up links to each other's instant messaging platforms step by step," said Zhao Zhiguo, general director of MIIT's Information and Communication Management Bureau. The Chinese government believes blocking links "messes up users' experience, harms their rights, and disrupts the market." Since the government crackdown took place last year Tencent announced it would allow allow external links from eCommerce sites like Taobao and Tmall on WeChat. More than a billion people use WeChat daily to facilitate their eCommerce purchases and other tasks.