DoorDash’s Strategy, 4 Things You Need to Know

How long does it take to break a habit? Many believed that once the COVID-19 pandemic eased people would stop ordering in. But it turns out that many people have continued to do so even as health restrictions have eased. A survey found that 60% of adults and 71% of Millennials in the United States are more likely to get food delivered from restaurants now than they were before the pandemic hit. This change in habits has boosted the fortunes of meal delivery companies like DoorDash.

DoorDash’s revenues were up 69% in 2021 to reach $4.9 billion. 369 million orders were placed through DoorDash in the fourth quarter of 2021 and DoorDash now has a 58% share of the meal delivery market in the United States. But with companies like Uber Eats (24% share) and Grubhub (15% share) trying to steal share DoorDash is focused on staying on top and expanding its lead. If you are curious about what DoorDash is doing to standout in a very competitive market then consider these four elements of its strategy.

1. Expand outside of restaurant delivery. Consumers have come to expect faster and faster shipping times. But this is a service that is often difficult for retailers to provide. In a delivery and fulfillment survey covering retailers in North America and Europe retailers reported that only 35% of them offer same day delivery service. One of the reasons for this is that retailers often do not have the technology to show real-time order visibility. Another reason is that they can’t deliver on time since their warehouses are far from customers’ homes.

One of the ways retailers are fighting against these headwinds is by partnering with delivery companies like DoorDash. A DoorDash delivery person called a Dasher can easily pick items for a customer’s order at a nearby store alleviating the need for a retailer to build a network of warehouses closer to its customers’ homes.

Recognizing this as a vital service retailers need to keep up with the likes of Amazon, DoorDash continues to expand outside of its core restaurant delivery business to serve more and more retailers. Last year DoorDash became a delivery partner for PetSmart, Bed Bath & Beyond, Ulta Beauty, Pacsun, Lush and JCPenney. These delivery partnerships help retailers to offer faster, same day delivery service and also make stores more productive as they are used to fulfill online orders. "Look at Bed Bath & Beyond. Those stores — there are so many of them and they're so under-leveraged," said Dean Maciuba, managing partner of Crossroads Parcel Consulting and a 35-year FedEx veteran. DoorDash’s partnership with Bed Bath & Beyond essentially turns its stores into mini fulfilment centres, making the case that perhaps retail stores aren’t dead afterall.

Not only do retailers benefit from this type of partnership but it provides DoorDash with a more lucrative source of revenue. When DoorDash delivers groceries on behalf of Walmart it doesn’t have to invest in marketing to acquire those customers, instead Walmart provides a large and steady flow of business that is driven by the frequency of grocery shopping, Walmart’s own marketing activities and Walmart’s scale. In December of last year 14% of DoorDash’s monthly active users placed an order from outside of the restaurant category and those types of orders are growing.

2. Get more customers to subscribe. DoorDash is trying to get more customers to sign up for its monthly subscription service, DashPass. DoorDash launched DashPass in 2018 and for a $9.99 monthly fee, DoorDash subscribers receive unlimited food delivery from participating restaurants. More than 10 million customers or 40% of DoorDash’s active customers have signed up for DashPass.

Customers subscribed to DashPass tend to buy food from a wider variety of restaurants, which increases the stickiness of the program which in turn makes those customers more profitable in the long run. If you are subscribed to a loyalty program you are less likely to take your money elsewhere since you have already made an investment in one provider. Amazon knows how well programs like these can work. “So if you look at total revenue per MAU for a DashPass user versus somebody that doesn't use DashPass, the total dollars of revenue or total dollars of gross profit for a DashPass consumer tends to be higher than they do for non-DashPass consumers,” says DoorDash CFO Prabir Adarkar. “With DashPass, we're making a trade-off to accept lower unit margins in exchange for significantly higher order frequency. And so as the order frequency increases, you generate more orders and those orders translate into greater cumulative contribution profit for each user,” said Adarkar. With such thin margins in the meal delivery business the war for customer retention is on with the hopes that a loyal customer base will generate more profitable returns in the long run.

3. Become a one stop shop for delivery. In 2020 DoorDash launched DashMart which is an online convenience store that sells over 2,000 items including snacks, fresh and frozen groceries and household essentials. DashMart orders are fulfilled through micro fulfillment centres owned by DoorDash and orders are picked and delivered by Dashers. DoorDash has 74 of these fulfillment centres in the United States.

Why sell convenience items? Ask Walmart. A huge part of Walmart’s success came from expanding into the grocery category decades ago. When you sell items like chips or milk there is a reason for customers to shop with you on a frequent basis. Now DoorDash customers have one more reason to use its service on a weekly basis. DoorDash has expanded aggressively into the convenience category and now has more than a 45% share of the convenience store delivery market in the United States, with Gopuff coming in second with a 23% share, Instacart is in third place with a 16% share and Uber Eats is in fourth place with a 15% share.

In line with DoorDash’s goal to get you to place more orders on its app, last year it launched DoubleDash which allows customers to add items from multiple stores to their order without paying an extra fee. With this service if you order ramen noodles from your favourite spot you can have your Dasher pick up a bottle of wine en route to delivering your order. In December DoorDash announced that a DashMart in New York will fulfill orders in as little as 15 minutes. “So first, for consumers, a lot of these DashMarts just bring selection of inventory into geographies where, frankly, didn't previously exist, whether literally it never existed or the hours of operation has now opened pretty wide to 24/7 now, which is a big improvement for what consumers are seeking. I think with respect to merchants, this is a critical infrastructure for a lot of them, either to expand into new geographies or to increase into different hours of operations,” said Tony Xu, DoorDash’s co-founder and CEO. “And so DashMarts are really a form of infrastructure to store inventory to possibly enter new geographies and certainly expand their hours of service.”

The hope is that with services like DoubleDash and DashMart as well as fulfilling orders from retailers DoorDash will become a destination for delivered goods. “Our goal with our Marketplace is to build a world-class local commerce platform. Our analysis continues to suggest consumers who order from non-restaurant categories subsequently increase their order volume on our Marketplace as a whole and in the restaurant category by more than consumers who do not order from new categories,” writes DoorDash in its 2021 shareholder’s letter. “This supports our view that a scaled multi-category experience can drive improved retention and order frequency over time.” Perhaps this is how Amazon thought of its future 20 years ago.

Do you like this content? If you do subscribe to our retail trends newsletter to get the latest retail insights & trends delivered to your inbox

4. Build an advertising business. It’s not a secret that it’s hard to make money in retail or in logistics. While most people focus on Amazon’s dominance in eCommerce, Amazon should really be revered for its ability to make money in ways retailers have not. Just a little over a decade ago Amazon started an advertising business. When you are shopping on Amazon you will notice that over the last several years the number of sponsored ads have increased. These are ads that appear in your search results that third party sellers on the platform pay for to help their products get noticed. That business became so large reaching $31 billion last year, Amazon had to disclose its size for the first time earlier this year.

Many retailers including Walmart and Target are now rushing to follow in Amazon’s footsteps to grow their advertising sales. Not wanting to be left out of digital advertising sales, third party delivery providers are also trying to get a piece of the pie. Instacart generated $550 million in advertising revenues in 2021 and Apoorva Mehta, Instacart’s founder and executive chairman has said that the company aspires to breakeven in its delivery business and generate most of its profits from advertising.

Delivery companies see advertising as a way to generate more profits since these sales have higher margins. In light of this DoorDash launched a new advertising platform last year that allows merchants to bid on ad placements. Instead of charging based on impressions or clicks as is the case on other platforms merchants only pay DoorDash if a customer clicks on an ad then makes a purchase. “Any mom-and-pop shop can go in, set a budget, and we only collect dollars if they get a transaction,” said Toby Espinosa, vice president of ads at DoorDash.

The reason why more profitable sources of revenues are in demand by third party delivery companies is because these companies are still struggling to find a sustainable business model. DoorDash has never generated an annual profit in the nearly ten years it has been in existence. The only time it made a quarterly profit was in the second quarter of 2020 where it made a profit of $23 million. "It took a global pandemic to drive the firm's one quarter (ended June 30, 2020) of GAAP profitability. The firm has not been profitable since, and we think it may never be," said David Trainer, the CEO and founder of New Constructs speaking about DoorDash.

In a particularly revealing shareholder’s letter in October of 2019 GrubHub wrote: “we didn’t then, and still don't believe now, that a company can generate significant profits on just the logistics component of the business. It is a commodity and there are significant variable costs that are hard to leverage even with technology and scale.” “Bottom line is that you need to pay someone enough money to drive to the restaurant, pick up food and drive it to a diner. That takes time and drivers need to be appropriately paid for their time or they will find another opportunity.”

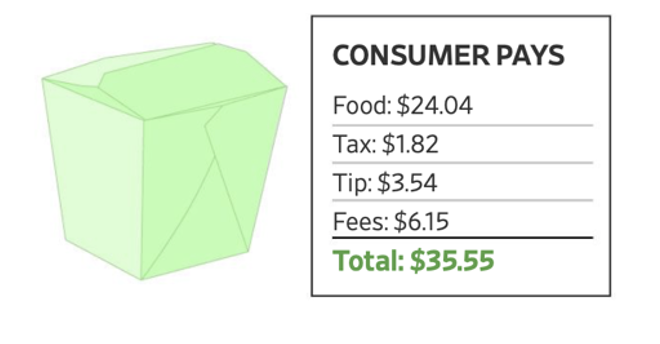

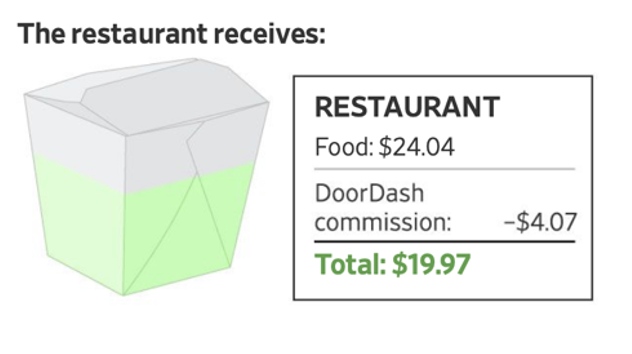

A recent analysis by Deutsche Bank which appeared in the Wall Street Journal highlights the challenges of the third party delivery model.

Deutsche Bank estimates that on average DoorDash makes $0.90 per order on meal delivery (note: the remaining $4.85 in the exhibit above is DoorDash’s commission per average order of $4.07 + fees of $6.15 – delivery fees of $5.37). Deutsche Bank estimates DoorDash makes a profit of $2 on the orders it delivers for retailers like Macy’s versus the $0.90 it makes on meal delivery. This underscores why DoorDash is keen on bringing in new and more profitable sources of revenue.