How Amazon Makes Money In Ways Other Retailers Do Not

Many years ago, Amazon stumbled upon a well-known secret, it’s hard to make money in retail. While the Macy’s and Sears of the world duke it out trying to optimize businesses that are in decline, Amazon has entirely different aspirations. Perhaps Amazon’s greatest accomplishment is not how many Prime subscribers it has (150 million and counting) but its ability to make billions of dollars in profits.

Amazon made $11.6 billion in profits on $280.5 billion in revenues in 2019. $9.2 billion of Amazon’s $14.5 billion in operating income in 2019 came from Amazon Web Services (AWS). Who would have thought 26 years ago when Amazon started as a bookseller one day it would be the market leader in cloud computing. Amazon’s cloud computing business is widely successful and is a major contributor to Amazon’s financial position.

There is a near universal obsession with chasing Amazon. Retailers are pouring more and more into their online operations, delivery times are getting faster by the minute and consumers are enjoying better service. But for many retailers it’s a zero-sum game. They are trying to compete with Amazon while Amazon is engaged in an entirely different game. Amazon is like having a cloud services company (Microsoft), an advertising juggernaut (Google), a marketplace (eBay) and traditional retailer (Target) all in one company.

What retailers should take away from Amazon’s success is how to think differently about the business they are in and to experiment with new streams of revenue even if they are outside of retail. If Amazon can do it, so can you. Remember…Amazon started out as a bookseller, at a time when a cloud was well…a cloud. For some inspiration here are the main ways Amazon is generating its profits.

1. Amazon Web Services (AWS)

In 2006, 12 years after Amazon went into business it launched Amazon Web Services (AWS). As Amazon writes on its website: “in 2006, Amazon Web Services (AWS) began offering IT infrastructure services to businesses in the form of web services -- now commonly known as cloud computing. One of the key benefits of cloud computing is the opportunity to replace up-front capital infrastructure expenses with low variable costs that scale with your business. With the Cloud, businesses no longer need to plan for and procure servers and other IT infrastructure weeks or months in advance. Instead, they can instantly spin up hundreds or thousands of servers in minutes and deliver results faster.”

As the Guardian explains with AWS: “you can buy storage space to hold a huge database, bandwidth to host a website, or processing power to run complex software remotely. It lets companies and individuals avoid the hassle of buying and running their own hardware, while also letting them pay for only what they actually use.” Netflix is one of AWS’ most prominent clients, using the service for most of its cloud computing and storage needs.

AWS is now the largest cloud infrastructure business in the world. It is also Amazon’s profitability engine responsible for 63% of Amazon’s operating income in 2019 despite only generating 12.5% of Amazon’s revenue. Amazon’s retail business had operating margins of -1% in 2019, while AWS’ operating margin was 31.1%. As a separate business AWS could have a $500 billion dollar valuation. Not bad for a “retailer.”

2. Advertising

Facing narrow margins in their core retail business Amazon as well as Walmart and Target have continued to look for other ways to generate profits. Within the last few years advertising revenues have surfaced as a bright spot for these retailers. Digital advertising is a huge business with total ad revenues reaching $325 billion in the United States in 2019. Most of the digital advertising revenues go to Google (29.4% share) and Facebook (23.4% share) but retailers are trying to change this.

Retailers argue that: “Facebook might know what your customers like, and Google might know what they want, but only we know what they actually buy.” It is estimated that Walmart.com with 140 million monthly visitors has the second highest number of monthly unique website visitors for a US retailer behind Amazon at 200 million giving them a treasure trove of data that Facebook and Google wish they had. Walmart is only now starting to take advantage of this traffic to drive advertising revenue. Walmart CEO Doug McMillon has said: “we have a tiny ad business. It could be bigger.”

Amazon’s “other” category which is primarily compromised of advertising revenues passed the $10 billion mark in 2018 and it is estimated that Amazon’s advertising business will generate $17 billion in 2020 making it the third largest digital advertiser in the United States. Analysts estimate Amazon’s advertising business has margins as high as 75%. Amazon now has a 9.5% share of the digital advertising market in the United States. American retailers are actually playing catch up in this area as Chinese eCommerce giant Alibaba has long had advertising as part of its business model and will generate an estimated $27 billion in advertising revenue in 2020.

Do you like this content? If you do subscribe to our retail trends newsletter to get the latest retail insights & trends delivered to your inbox

3. Third-party online sales

There are two ways of selling on Amazon. Either Amazon purchases a company’s inventory and resells it (first party sales) or a company sells its products on Amazon’s marketplace directly to customers and Amazon takes a cut of the sale.

First party sales are by invitation only. In this case Amazon purchases goods at wholesale prices. Amazon owns the inventory, warehouses it, sets pricing, fulfills orders including shipping and handles customer care. Third party sellers on Amazon are independent sellers that sell a range of new and used merchandise. These retailers are usually small to medium sized business owners. Your local mom and pop store might sell on Amazon to increase their reach. There are more than 2.3 million small and medium businesses selling their goods on Amazon’s marketplace today.

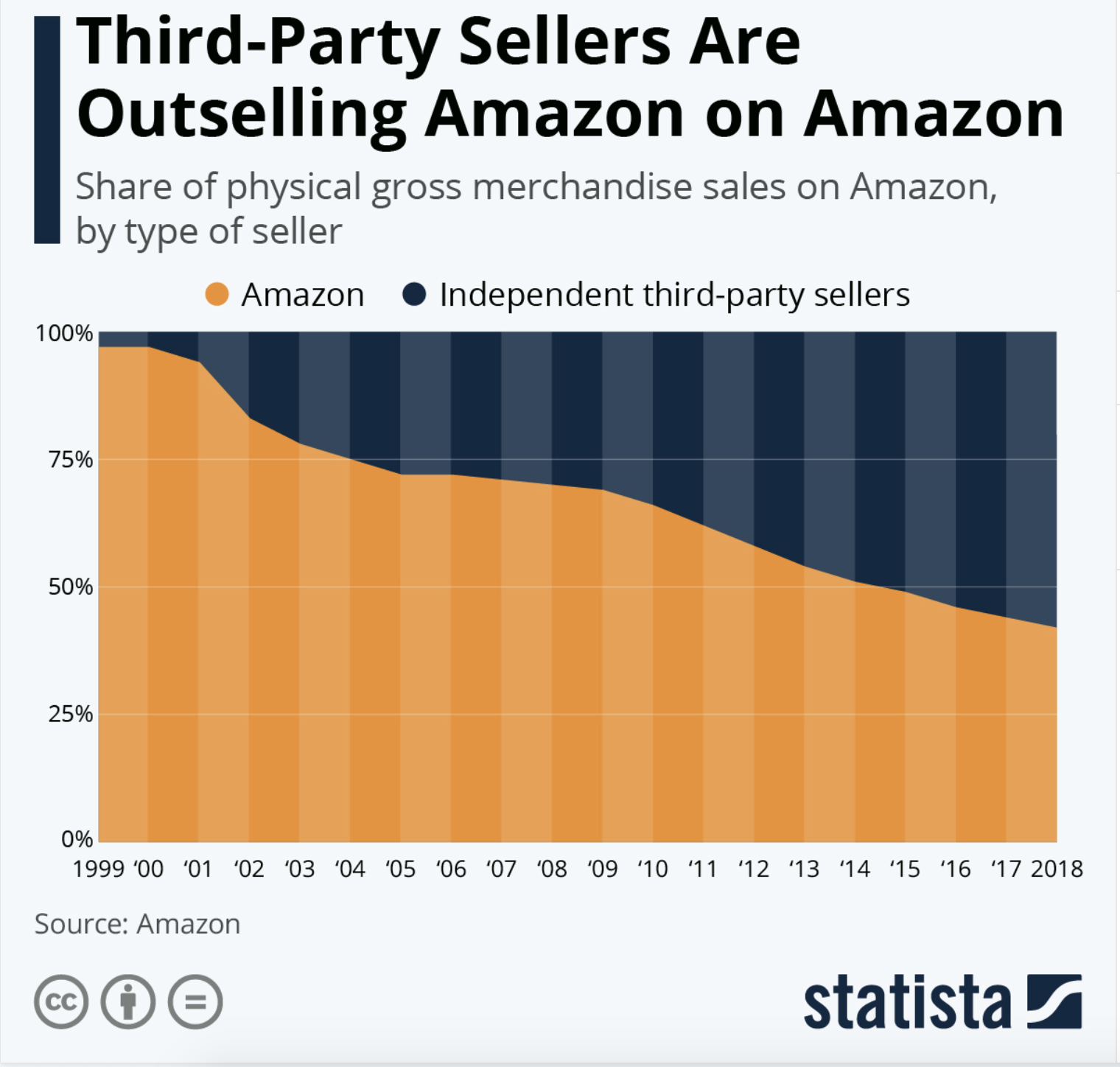

Over time the percentage of Amazon’s sales generated by third party retailers has increased dramatically. Amazon now has the largest marketplace for third party sellers in the United States and approximately 60% of Amazon’s eCommerce sales are from third party sellers. In the fourth quarter of 2019 third party sales generated $17.4 billion dollars which includes fees for commissions on sales (15% to 20% of the sale) and fulfillment services.

Third party sales are more profitable for Amazon. It is estimated that Amazon’s gross margin rate from these sales is: 60% to 75% which is higher than the margin it makes on first party sales.

Walmart is also making a concerted effort to drive more traffic to its website by adding more third-party sellers. Since Walmart’s marketplace is not as crowded as Amazon’s individual sellers may have a better chance at getting noticed on walmart.com. Between 2016 and 2017 Walmart went from having 10 million items on its website to having 50 million.

4. Prime

And then there was Prime, Amazon’s widely successfully subscription service launched back in 2005. Amazon Prime, with over 150 million Prime members, helps to subsidize the cost of Amazon’s eCommerce business. Amazon prime membership has turned out to be an effective loyalty program with members shopping more frequently at Amazon and spending more than non-Prime members.

Amazon’s subscription services category which includes revenue from Amazon’s Prime memberships generated $6.0 billion in the second quarter of 2020. But the benefits offered through Prime and thus the cost of program have increased over time.

Recently Walmart followed in Amazon’s footsteps again when it launched Walmart+ which is largely a delivery subscription service. It’s no Amazon Prime but it will help to subsidize delivery costs. Walmart is one retailer that has taken a page out of Amazon’s playbook by expanding its marketplace, focusing on advertising and introducing its own subscription service.