5 Growth Opportunities in Retail Worth Investing In

While 2020 is a challenging year for the retail sector and the world as a whole there are some bright spots. Let’s take the resale sector. With consumers tightening their purse strings and focused on protecting the environment resale is an opportunity retailers shouldn’t ignore. Gucci even entered into a partnership with resale platform The RealReal earlier this month, something that would have been unthinkable even a few years ago.

With studies showing that the United States economy is in a K shaped recession where wealthier consumers are recovering while poorer constituents struggle to stay afloat lower priced retailers like Walmart and Dollarama are finding success. "A lot of the jobs that were lost are at the lower end of the income distribution spectrum. Lower earners are struggling more. Whether you want to call it a K-shaped recovery or not, I do think there's been a wide gap between the haves and the have-nots. People who started off wealthy have recovered much more rapidly than those that were struggling before," says Eric Winograd, Senior Vice President and Senior Economist for Fixed Income for AllianceBernstein.

If you are looking for your next business opportunity do not despair, consider these opportunities as they are poised for success.

1. Resale

The resale market is heating up. At 6% of total footwear and apparel sales it is not the largest segment of retail but it is growing quickly. It is estimated that the resale apparel market will double from $24 billion in 2018 to $51 billion by 2023. Part of this growth is due to consumers seeking more sustainable options in an effort to protect the environment. 1.2 billion tons of greenhouse gas emissions are produced each year as a result of textile production and donating or reselling clothing is a way for consumers to become more environmentally friendly. A survey of resale platform Vestiaire Collective’s members found that 54% purchased or sold an item on the site because they wanted to shop in a more sustainable manner.

Resale also allows consumers to trade up and buy that Gucci bag they normally would not be able to afford. Second hand clothing is especially popular amongst millennial and Gen Z consumers who buy second hand items more than twice as much as the average consumer.

The fixation with Instagram among these consumers has also boosted the resale market. Young consumers interested in building their online audience want to have a constant rotation of outfits to pique the interest of their followers. The ability to buy cheaper resale clothing or to easily sell one’s closet online provides a source to fund a constant rotation of outfits.

Seeing the potential of this segment of the market earlier this month Gucci established a partnership with second hand platform The RealReal where Gucci will directly provide second hand products, such as bags used in photoshoots directly on the platform.

Many also consider reselling clothing or sneakers a lucrative side hustle with some turning this part time gig into a full-time job. Resale platforms such as Poshmark, The RealReal and ThredUp which make buying and selling online easy are facilitating the growth of this segment. 50 million people use Poshmark and five million of those users are sellers. In 2018 alone Poshmark made $1 billion in payouts to sellers.

2. The size 14+ clothing market

A largely underserved segment within the fashion industry is fashionable apparel for consumers who wear size 14 and higher. In 1980 the average size was size eight now 40 years later it is size 16. Although 67% of Americans wear a size 16 and above this segment of the market is largely ignored. According to the New York Times, annual expenditures on larger sized clothing only represents 16% of sales in the $112 billion apparel market in the United States. This is not by choice it is because of limited supply.

In addition to a lack of supply, consumers shopping within this segment are often stigmatized. Within retail stores the “plus” department is often located in the back of the store or on another level. Many designers refuse to make their clothes above a certain size especially within the luxury segment. It is telling that as recent as 2017 for the first time in Vogue’s history it featured a “plus-sized” model on its cover, Ashley Graham.

Even when the industry tries to serve this segment clothing tends to less fashionable as most of the attention is given to clothing that is made for consumers wearing smaller sizes. Retailers that continue to ignore this segment are missing an important opportunity to better serve the majority of society. While retailers continue to battle it out in traditional arenas there is a growing number of retailers that have identified the opportunity within the size 14+ market and are capitalizing on it. Some of these retailers are Fashion Nova, ModCloth, and ThirdLove.

Close to 75% of ModCloth’s clothing is available in sizes XXS to 4X. In a report from the Washington Post, Mathew Kaness, CEO of ModCloth said: "a lot of brands think very narrowly about who their customer is. There's this belief that ‘plus-size’ customers simply don't spend as much — but that is only because of a lack of choice."

Lingerie company ThirdLove has also had success by catering to the needs of women of all sizes. It offers bras in 78 sizes. Demand for larger sizes is only increasing as evidenced by a 500,000 person long waiting list it had for bras in sizes such as 44G and 46K.

Clothing sizes at Fashion Nova go up to size 3X. In an interview with Paper magazine, Fashion Nova CEO Richard Saghian said: “lots of fast fashion retailers offer trend pieces at low prices with quick, convenient shipping. Fewer create items that are suited to body types not seen in typical fashion campaigns. All our other competitors were always using the same models over and over. We thought we could be a little different by celebrating body positivity and using curvier girls and the customers liked it." Instead of offering a separate line of clothing for curvy women Fashion Nova offers many items in sizes ranging from extra small to 3X. Fashion Nova responded to customer feedback that their customers wanted the exact same style that may have only come in smaller sizes before.

lululemon started offering clothing in extended sizes for a selection of its assortment last month. The new sizes will extend lululemon’s size range up to size 20. Previously most of lululemon’s clothing went up to a size 14 with a few pieces offered in size 16. Lululemon calls the new initiative a “start” and more extended sizes are on the way. But critics argue the brand isn’t going far enough since it isn’t offering a broader range (i.e. up to size 34)

The opportunity within the size 14+ segment is real and consumers are clamouring for it.

3. Makeup that encompasses all skin tones

Rihanna took the beauty world by storm when she launched Fenty Beauty with 40 shades of foundation in 2017. Speaking about the launch one customer said: “I saw other dark girls in Sephora getting matched in this foundation and it literally melted my heart”.

The success of the brand led to Fenty Beauty being named one of Time's Inventions of the Year in 2017. Speaking about her line Rihanna said: “it was important that every woman felt included.” Shortly after launch, the darker shades began to sell out at Sephora. Several other brands including Dior have since come out with products in broader range of colours

As many people know, Fenty Beauty launched with 40 shades of foundation. But Fenty Beauty was not the first brand to offer 40+ shades of foundation. For example, Make Up For Ever even stated in an Instagram post after the launch of Fenty Beauty: “40 shades is nothing new to us.” The bigger question is how did Rihanna manage to disrupt when others failed to barely innovate?

Other beauty brands with a diverse range of shades have not made marketing themselves as brands serving all as a central part of their business model. Rihanna, from the beginning wanted to serve everyone. Not just dark-skinned consumers but everyone. Speaking about her line of foundation Rihanna said: “there needs to be something for a dark-skinned girl; there needs to be something for a really pale girl; there needs to be something in-between." One key difference is in how Rihanna marketed Fenty Beauty which Time magazine noted as being part of the genius behind the success of the brand. Fenty Beauty uses models from many ethnicities allowing the brand to become known as “the new generation of beauty”. Rihanna focused on all women and now all women can’t stop buying her products.

Do you like this content? If you do subscribe to our retail trends newsletter to get the latest retail insights & trends delivered to your inbox

4. Price conscious consumers

Despite claims of millennials spending all of their money on luxuries like avocado toast they are struggling economically. In a repor, the Federal Reserve writes that: "millennials are less well off than members of earlier generations when they were young, with lower earnings, fewer assets, and less wealth."

All of this is bad news for consumers but good news for retailers targeting the price conscious. It’s not a coincidence that the lower end of retail has performed well. Some of the most successful retailers today include Dollar General, Burlington Stores, Costco and Walmart. They all target the low end of the price spectrum. Walmart is the largest retailer in the world for a reason. Many consumers started shopping at these retailers during the last recession and kept shopping at these stores once the recession was over. This shift in shopping habits has negatively impacted retailers in the middle of the pricing spectrum like JC Penney, Sears, Gap and Kohl’s.

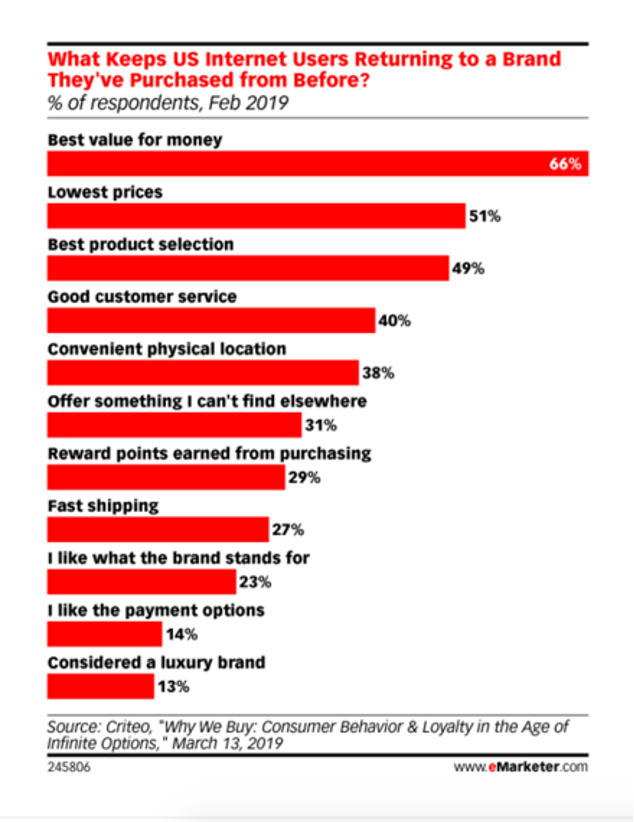

A report from eMarketer underscores why retailers like Walmart are performing well. When shoppers were asked what the most important factors are for deciding whether or not to return to a brand shoppers ranked value for money first followed by lowest prices.

One of the trends that has accelerated in recent years is the squeezing out of retailers targeting the middle of the pricing spectrum, like Gap or JC Penney that aren’t too expensive or too cheap. Between 2012 and 2017 sales at retailers in the middle of the pricing spectrum increased by only 2% while sales at premium and price-based retailers in the United States increased by 81% and 37% respectively during the same timeframe.

While increasing competition from Amazon is often cited as the reason mid-priced retailers are suffering the main reason has to do with economics. In 1985 it took a male breadwinner 30 weeks to pay for critical expenditures like housing, healthcare, transportation and education. By 2018 it took 53 weeks. Consumers have less money to buy many of the items retailers sell. And when they do make a purchase they are choosing lower priced retailers over mid-priced retailers out of necessity. COVID-19 is a double whammy since many consumers reigned in their spending habits after the last recession hit and never looked back. Now with the pandemic the situation is even worse.

It is telling that even before the pandemic, Todd Vasos Dollar General’s CEO said: “the middle-class continues to go away, unfortunately, to the lower end of the economic scale versus the higher end.” “So as this economy continues to chug along and creates more of our core customer, I think there’s going to be more and more opportunities for us to get in and build more stores.” If only he knew how right he would be.

5. Health and wellness

Is health and wellness a trend or a way of life? The Global Wellness Institute estimates that the wellness industry is worth $4.2 trillion and is growing quickly. Between 2016 and 2018 the industry grew at rate of 12.8%. But what exactly constitutes health and wellness and how are companies capitalizing on it? The top two categories within the wellness industry are: personal care and beauty (valued at $1 trillion) and healthy eating, nutrition and weight loss (valued at $702 billion). Speaking about the trend in health and wellness, Senior Research Fellow, Ophelia Yeung, at the Global Wellness Institute said: “in the last few years, wellness has become a dominant lifestyle value that is profoundly changing consumer behavior.”

The COVID-19 pandemic has ushered in a more pressing focus on health and wellness. As with any life-threatening situation whether it’s yours or someone else’s it makes people pause and take stock of their life. In China, purchases of vitamins, minerals and supplements quickly spiked after the onset of the pandemic. Now that consumers are more aware of their mortality it is likely that they will continue to be more health conscious in the future. For example, 75% of Chinese consumers surveyed said they will adopt a healthier lifestyle as a result of the pandemic. Speaking about changes in consumer behaviour after the outbreak of SARS in the early to mid 2000s, Ryan Zhou, Vice President, Consumer Packaged Goods, Nielsen China said “health and hygiene is a natural habit shift post epidemic, and we observed a continuous boom in this area after SARS. Now is a key time for brands to consider upgrading for health and hygiene concepts” 52% of Chinese consumers surveyed said they will look for foods or medicines that will strengthen their health and boost their immunity.

It is also expected there will be a demand for more clean products. This is a movement that has been going on for some time. For example, Sephora launched Clean at Sephora in 2018. The goal of the program is to make Sephora the place to go to for non-toxic beauty products. Clean at Sephora brands do not include ingredients such as sulfates, parabens or formaldehyde. Sephora’s Chief Marketing Officer, Artemis Patrick, says that: "many [customers] are looking to shop brands and products that are 'free of' and Sephora is responding to help them do that, easily and conveniently in-store, online, and on mobile." All brands within the program can be identified by a "Clean at Sephora" seal.