The Downfall of Sears, 5 Reasons Why it’s Struggling to Survive

Did you know that at one time Sears was the largest retailer in the world? That was back in 1969. During that time Sears was so dominant its sales represented 1% of the entire United States’ economy with two thirds of Americans shopping there. A few decades later when Sears merged with Kmart in 2005 the combined organization generated a substantial $55 billion in revenue.

Fast forward less than two decades later to 2018 when Sears was in so much financial hardship with declining sales and profits as well as mounting debt it filed for bankruptcy. Hedge fund manager Edward Lampert, who is also Sears’ former CEO and largest shareholder, purchased the company in bankruptcy proceedings for only $5.2 billion. Now Sears has only 12 stores and three Kmart stores down from over 3,500 Sears and Kmart stores at its peak.

What a fall from grace. But what happened? Nothing that dominant goes down overnight, it took decades to seal the fate of the once iconic retailer. Much has been written on this topic and one day when the movie comes out about the fall of an icon I’ll be sure to watch it. But the problems Sears has faced from a lack of innovation to an inability to stay ahead of competitive threats are ones that challenge even the best organizations. But at some point there is a tipping point when a company fails on so many fronts it’s impossible to get back up. That’s what happened with Sears.

As you mull over your own thoughts and ideas about what happened to Sears, take into consideration these five factors I believe ultimately led Sears to where it is today.

1. A failure to keep innovating. When Sears came on the scene in 1893 it was the retailer others wanted to emulate. Richard Sears was a visionary. He foresaw that America’s growing railway infrastructure could be used as a way to send goods to consumers in rural communities that lived far away from stores. That insight was the impetus for Sears’, at one time, immensely popular, catalog. Consumers were finally given a way to access merchandise at much lower prices than what was available from nearby merchants. It was a runaway success.

His next wave of brilliant insight? Retail stores. Sears correctly calculated that with the introduction of cars rural consumers that were once dependent on the Sears catalogue would have more access to other retailers. Sears took this threat seriously and started opening stores in the 1920s and by 1931 sales from Sears’ stores outstripped catalogue sales.

Don Katz, author of the book “The Big Store”, which provides an insider’s look at Sears says Sears reinvented the future not once but twice when it opened up brick and mortar stores. "[Sears] decided that the automobile was the key to what was going to happen to commerce in America," says Katz. "He began to buy the crossroads outside of cities and towns all over the country." Those crossroads eventually became the suburbs. When people arrived in the burbs Sears was ready for them. Sears was: "completely innovative. They were inventing consistently," says Katz.

Sears did not stop innovating there. In 1985 Sears launched the Discover credit card the first of its kind to offer cash rewards based on the amount of purchases a cardholder makes. In only four years 20 million people had a Discover card. With all of this innovation Sears sounds less like a sleepy retailer and more like the Amazon of its time. But like many companies that fall to the perils of time, at some point Sears stopped innovating. It stopped doing the very thing that made it successful in the first place.

Why do companies stop innovating? It is usually because the drive and motivation that is necessary to create something out of nothing fades over time as the glow and trappings of success set in. Why experiment with something new if it might fail, bring reputational risk or forfeit current profits? Self-preservation is often the biggest enemy of success. Life is about growth and progress and as history shows it is unkind to those that try to hang on for too long to what made them successful in the past.

2. An inability to stay ahead of competitive threats. While often the discussion about Sears’ fall from grace focuses on the rise of Amazon, there is less discussion about the growth of a very formidable competitor Walmart. At one point, in 1990, Sears and Walmart were practically the same size, generating revenues of $31.9 billion and $32.6 billion respectively. Walmart saw a future in discount retailing and aggressively went after that market chipping away over time at consumers that once would have shopped at Sears.

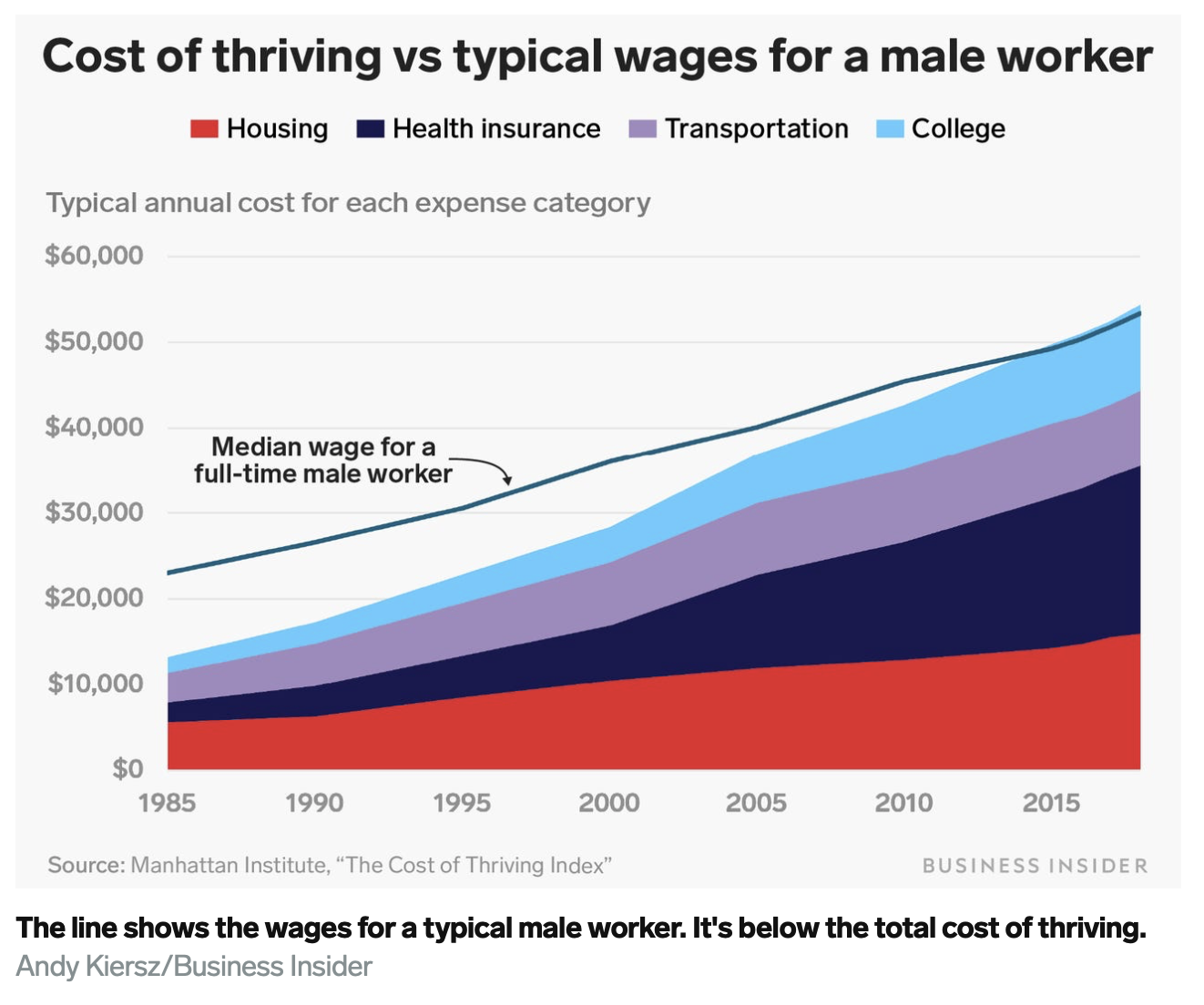

Most mid-priced retailers like Sears or JCPenney or Gap are struggling not just because of poor assortments but due to consumer economics. In 1985 it took a male breadwinner 30 weeks to pay for critical expenditures like housing, healthcare, transportation and education. By 2018 it took 53 weeks. As you can see in both charts, both male and female breadwinners are living below the cost of living line.

According to The Pay Scale Index: “since 2006, wages have risen 34.7% overall in the U.S. But when you factor in inflation, “real wages” have actually fallen 10.9%. In other words, the income for a typical worker today buys them less than it did in 2006.” What does all of this mean? Consumers have less money to buy many of the items retailers sell. And when they do make a purchase they are choosing lower priced retailers over mid-priced retailers out of necessity.

At some point Sears was simply priced out of the market by discount retailers like Walmart and Target. As the Economist writes: “Sears was not alone in occupying the uncomfortable ground between discounters whose prices it could not match and high-end retailers whose stores and products outshone its own.”

Sure Sears doesn’t have the best assortment. But does Walmart really have the best assortment in clothing? No. But it has managed to be the second largest clothing retailer in the United States, behind Amazon, another retailer that doesn’t have the best assortment in clothing, a key department store staple. But what both retailers offer is good value for your money.

All of the chatter about the shift to online sales and Sears’ inability to keep up conceals deep shifts in consumer behaviour and consumption. Sears missed those shifts and by time it figured it out it didn’t have the margins to do anything about it.

Do you like this content? If you do subscribe to our retail trends newsletter to get the latest retail insights & trends delivered to your inbox

3. A lack of focus. Much has been written about how Sears started out as a humble watch and jewellery seller. Then fast forward years later it sold everything under the sun. You could go to Sears and buy books, bicycles, pianos, sewing machines, ready to assemble homes and even cars at one point. But if you look at Amazon it is also in many categories including cars now. So is Walmart. Lack of focus didn’t bring down Sears but it certainly contributed to it. At some point Sears became so unwieldy that it was difficult to manage the business effectively. Think about going to a retail store to buy an outfit for an event and turning around and seeing a line of shiny fridges against the wall. It’s easier to have an assortment like that online but it’s hard to make a store experience like that work.

In an effort to target more women Sears launched “The Softer Side of Sears” ad campaign in 1993. The campaign was seen to many as an indication that Sears had started to move in the wrong direction as the retailer focused more on selling clothing and other “soft” goods to increase frequency of visits and take a greater share of wallet. This alienated Sears’ existing customers at the time which saw Sears as a destination for appliances, mattresses and electronics.

In reality what likely happened was that Sears lost its north star. What was its reason for being? Sam Walton, founder of Walmart once said: “if we work together, we'll lower the cost of living for everyone...we'll give the world an opportunity to see what it's like to save and have a better life.” That’s a powerful vision and one that is still a battle cry for Walmart decades later. But for Sears that sense of self was lost as it over expanded into category after category.

Struggling to achieve its past dominance Sears merged with Kmart in 2005. Mergers are hard. Trying to seamlessly integrate two different cultures, different systems and processes is hard for even the strongest of companies. But for a company that had already moved in too many directions, the merger took a heavy toll on Sears.

“The solution to Sears’ problems was to buy another retailer not doing well, and that was Kmart. Then they got a bigger bad business,” said Neil Saunders, managing director of GlobalData Retail. “Sears wasn’t investing or changing, and they started to suffer because of that.” Even legendary investor Warren Buffet commented on the deal: "Eddie is a very smart guy, but putting Kmart and Sears together is a tough hand," said Buffett. "Turning around a retailer that has been slipping for a long time would be very difficult." "How many retailers have really sunk, and then come back?" "Not many. I can't think of any." Leave it to Buffett to provide those famous last words.

4. A lack of continual and sustained investment. Success in retail is founded in continual and sustained investment back into the business. Stores are capital intensive and so is managing and growing an eCommerce business. Over time Sears stores started to look tired. That was not by accident. Over the years Sears stopped investing in its stores. In 2017 Sears spent approximately 91 cents per square foot to upgrade its stores and eCommerce site. At the same time JCPenney spent $4.13 per square foot, Kohl’s spent $8.12, and Best Buy spent $15.36 to make upgrades. As Sears’ stores fell further into disrepair they couldn’t generate enough to finance their own upgrades leading to a negative investment cycle which generates lower and lower sales and less money to invest over time.

Lampert is credited with much of this lack of investment. In a 2007 letter to investors Lampert wrote: "unless we believe we will receive an adequate return on investment, we will not spend money on capital expenditures to build new stores or upgrade our existing base simply because our competitors do. If share repurchases or acquisitions appear to be more productive, then we will allocate capital to those options appropriately." It looks like he was true to his word. “He did nothing to maintain the stores — nothing to spiff them up and make them a nice place to go shopping,” says Robin Lewis CEO of the Robin Report and a retail industry analyst.

Lampert also had a habit of selling Sears’ real estate assets for cash. For example, in 2015 he spun out 250 of Sears’ best properties into a REIT called Seritage with the goal of turning the former Sears and Kmart locations into more valuable uses such as offices and restaurants. The New York Times writes that: “Mr. Lampert has been accused in lawsuits filed by pensioners and Sears shareholders of picking apart the more-than-a-century-old retailer to enrich himself.”

“Sears has sold most of its top real estate over the past ten years and its remaining properties may not be worth much,” said Edward Jones analyst Matt Kopsky. “I don’t see a scenario where this improves.” It’s hard to put your best foot forward when you cut off your foot. Selling off your best assets and using a declining asset base to save a company is a recipe for distress.

5. Too many missed opportunities. By the late 1980s the very asset that brought Sears its initial success started to weigh down the retailer. Sears’ catalog business was losing up to $1 million per day. The main culprit, something every retailer can relate to, high delivery costs. Distributing a catalogue with as many as 1,500 pages was expensive especially since Sears sold low margin items. Sears shut its catalogue business down in 1993 only to build an online business, which has many synergies with a catalogue business, from scratch in 1997.

“What they missed was the second transition—they stopped producing their catalog the year before Amazon launched. What they failed to see was the next phase,” said Robert Hetu research director with Gartner’s Retail Industry Services team. “They failed to see that, yes, the traditional catalog was maybe not the way forward but the digital catalog would be. Theoretically, if they had the vision, they could have figured out how to move the catalog into eCommerce, but they didn’t do that,”

Sears has also sold scores of stores over the years. What was once a little known secret has come to the forefront, stores are one of the keys to the success of any retailer with an eCommerce business. Ask Target or Walmart who were able to effectively manage a surge of eCommerce orders during the pandemic by offering click and collect.

Between 2013 and 2017 as Sears reduced the number of its stores from 828 to 570 its online sales declined by half to reach $1.3 billion. Lampert’s strategy of focusing on Sears’ online business while ignoring retail stores came at a high cost. While Sears made some improvements to the search function on its website and improved the website’s ease of use those upgrades were not enough. Walmart on the other hand made a big bet on integrating its online and offline businesses. For example, Walmart launched grocery pick up in 2014 and now more than 4,500 Walmart stores offer grocery pickup. Walmart now has the second highest share of eCommerce sales in the United States.

One of the real threats Amazon has posed in the retail sector is distracting retailers from focusing on their core business. It’s not that eCommerce isn’t important because it is but when it accounts for 15.6% of retail sales as it did in the third quarter of 2022 in the United States then you had better have a really good handle on the part of your business that is generating most of your revenue and more importantly profits which are your bricks and mortar stores. As seen with Sears it can be easy to lose sight of the big picture when a new competitor is in town making waves.